The budget

Fiscal stuff – when will the government tackle the hard task of raising taxes?

Having endured many years of Coalition governments we have been conditioned to believe that a government’s most important economic function is to achieve a fiscal surplus.

No one should judge a budget on the size of its cash surplus or deficit.

Fiscal management is one small part of economic management, and there’s no virtue in achieving a surplus. A surplus is called for when the economy is overheating, and a deficit is called for when the economy needs a stimulus.

An ongoing deficit to finance recurrent expenditure (pensions, health care and so on) is unsustainable. That’s a “structural deficit”. But a cash deficit to fund investment (infrastructure, industry adjustment, public housing) is sound economic management, provided resources to fund those activities are available in the community.

In fact when we look at this government’s fiscal record – two successive surpluses of less than one percent of GDP, followed by the coming year’s one percent deficit – it’s reasonable to say that its fiscal policy, so far, is to have a balanced budget. Talk about this being an “expansionary” budget that will force the Reserve Bank to raise interest rates is partisan fearmongering. Australia has a conservative fiscal policy, in contrast to the US, Japan, and the UK, which are running fiscal deficits of four to six percent of GDP.

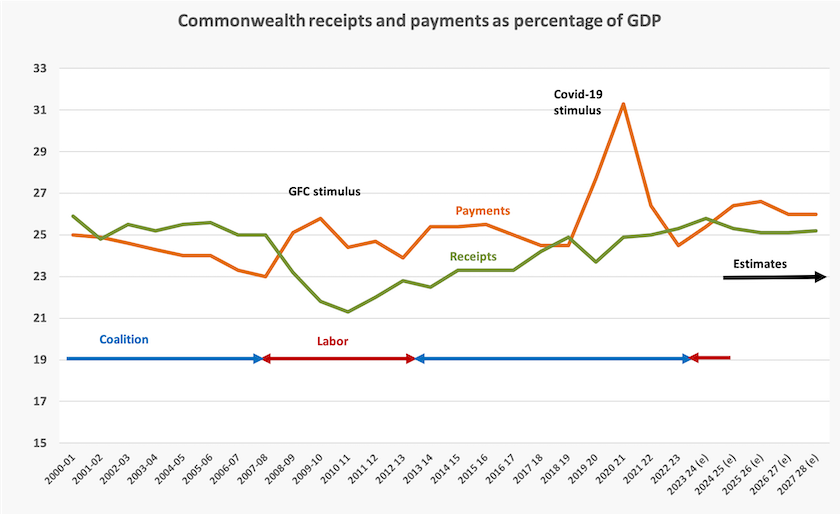

The Commonwealth’s fiscal record since 2000 is shown in the graph below. Receipts (green line) have generally been less than payments (orange line), ever since the Global Financial Crisis of 2008. We see one year, 2018-19, when the Coalition achieved a surplus, and the last two years when the Labor government has achieved a surplus, all razor thin and cosmetic rather than substantial.

Those surpluses are about bragging rights to keep ignorant and partisan journalists at bay. More significant is the forecast fiscal situation in the coming financial year and the three years to 2027-28. In view of the Reserve Bank’s over-zealous application of monetary tightening, and the deterioration in the world economy, it’s probably wise that the government is planning for a small fiscal boost in the coming year.

But beyond that is the ongoing demand of what the Treasurer calls “unavoidable spending”. Steve Bartos has a neat explanation of receipts and outlays the government can and cannot control in his Conversationcontribution Chalmers is bitten by the giveaway bug in a budget that contains good news for almost everyone.

That deficit is starting to look like a structural deficit. Kate Griffiths of the Grattan Institute, also writing in The Conversation, is quite clear in her assessment that the government is running a structural deficit: The budget is full of good news, but good news isn’t the same as good management.

The Coalition’s shadow treasurer Angus Taylor makes the same point about a structural deficit – probably the only valid criticism the Coalition makes. The Coalition’s line is to criticize Labor for reckless spending, without specifying what spending it would cut.

The reality is that unless the government were to embark on a radical austerity program, spending demands on the Commonwealth are bound to grow. Most government services make high demands on skilled labour (the “Baumol” effect), an ageing population will put more demand on various services, and the government is locked into expensive defence commitments.

Such is the nature of our economy that government revenue is heavily dependent on commodity prices. Iron ore prices for some time have been more than $US100/tonne, but in Budget Paper 1: Budget Strategy and Outlook (Page 53 ) they are forecast to fall to $US60/tonne. Forecasts of collapsing commodity prices are a recurring pattern, and it’s reasonable to ask whether they are based on considered calculations by Treasury experts, or political strategies designed to give the government the opportunity to announce a fiscal surplus. But for other commodities – metallurgical coal, thermal coal and gas – the day will come when their prices collapse, particularly if importers place a carbon adjustment price on them.

Angus Taylor is right: government expenditure is expected to grow faster than revenue. He also makes the point that it is rising faster than GDP, but that is simply about the Coalition’s “small government” obsession. Our governments are struggling to sustain the quality of public services, our public investments are inadequate for our future needs, and we need to bring privatized monopolies back on to the public balance sheet. The idea that having one of the smallest public sectors of all high-income countries is somehow good economic management is stupid.

The criticism that can be levelled against the government is that it has no plan to raise revenue. The Grattan Institute, in a pre-budget press statement by Aruna Sathanapally, called for tax reform, with a strong hint that taxes need to be raised. Almost every independent economist in Australia is calling for tax reform, and is critical of this government for having lost the enthusiasm for tax reform that was once characteristic of Labor in government and in opposition.

We need to raise taxes. The only sign of increased taxes, acknowledged in Budget Paper 1, is bracket creep. It’s convenient, but it’s hardly a defensible policy. Governments do not want to admit that their fiscal and economic policies rely in part on inflation.

Surprisingly there is no mention of the threat to fuel excise revenue from people taking up electric vehicles – only a mention that excise revenue may be lowered a little because of the new vehicle efficiency standards. At some stage we will need something to replace fuel excise, probably a federal road user charge. And in Budget Paper 1 (Page 182) there is a forecast that GST revenue will rise by only two percent next year. That will add to the difficulties faced by state governments, struggling to pay for expensive labour-intensive services – hospitals, schools and police forces.

A start to raising taxes would be for those with a public voice to acknowledge that Australia is a low and undertaxed country that is collecting too little public revenue to fund the services and investments we need to assure our future prosperity.

We have to change the way we talk about taxes, replacing negative talk about a “tax burden” with talk about how we can contribute to our shared prosperity – our common wealth. We have to dispel forever that silly Coalition-initiated idea that Commonwealth taxes should be capped at 23.9 percent of GDP, a ceiling that seems to have guided this budget’s projections.

A program of tax reform would restore full taxation of capital gains, with indexation. It would abolish the legally-sanctioned rort of family trusts. It would raise GST and abolish some of its exemptions. It would tax the incomes of so-called “self-funded” retirees. It would find ways to tax foreign-owned extractive industries adequately, particularly the gas industry. It would find ways to tax inheritances, and those who have huge accumulations of wealth. Anyone looking for opportunities to close tax rorts should turn to Page 167 of Budget Paper 1, where the cost of deductions and so-called “tax expenditures” are listed: $20 billion a year for concessions on superannuation earnings, $25 billion a year because the main residence is exempt from capital gains taxes, $27 billion a year because of “rental deductions”. The statement of tax expenditures is always rough, because it counts many deductions that are economically reasonable, but it gives an idea of where to look for revenue.

A program of tax reform would not only raise revenue, but it would re-shape our tax system so as to restore some incentive to engage in productive work and entrepreneurship.

Inflation and the cost of living – clever use of an inflation indicator

The Albanese government took the reins of a structurally weak economy. The Coalition government had made a justifiably large fiscal stimulus during the pandemic, but because the Australian economy had drifted along ever since 1996 without structural reform, that stimulus resulted in inflation, rather than producing anything of value. When Labor took office in May 2022, inflation, as indicated by the CPI, was running at 9 percent. This seems to be a familiar pattern: voters call on Labor to fix the Coalition’s economic failure.

Although journalists and even some economists make categorical statements about inflation, it is a complex and not fully understood phenomenon. It is hard to distinguish the self-perpetuating feedback cycle of rising prices → rising wages → rising prices → rising wages, from the price adjustments that follow a shock to the economy, such as a pandemic. There are several indicators of inflation, all with their biases (which generally overstate inflation).

But in its public presentation at least, the Reserve Bank has conveyed the impression that the CPI is the sole and authoritative measure of inflation. Therefore the government has responded with measures that will help bring down the CPI, with rental subsidies, a freeze on PBS prescription prices, and a $300 electricity bill subsidy.

Apart from the electricity bill subsidy these make sense in equity – after all it is a Labor government. There is some validity in the excuse that it would be hard to apply a means test to a subsidy based on households rather than individuals, but the main point is that by extending the payment to all households it is assured of being reflected in a lower CPI. Welfare groups, such as ACOSS, and some senators, have legitimately criticized the government for not raising Jobseeker and the Youth Allowance, but when they criticize the government for making the $300 electricity payment universal that misses the point: it is an inflation-busting measure as well as a distributive welfare measure.

Economists rightly point out that it’s wrong to use public expenditure to push down the CPI because the underlying driver of inflation is the public expenditure which adds to demand-induced inflation. Chasing an indicator is usually poor public policy. But the CPI has established a status that no-one wants to dislodge. Many government payments are linked to the CPI. Private contracts, such as rental agreements, are often linked to the CPI. Unions seeking pay increases use the CPI as a salient indicator. Firms use the CPI as a justification for price increases. Because of the way the CPI is used, keeping a lid on this imperfect indicator is consequential.

The economy – slowly rising wages, and a structural transformation

Obsession with the fiscal deficit, and “what’s in it for me” analyses, distract from the economic issues in the government’s budget. Strictly speaking, the budget is just another government bill, but the main part of its documentation is the government’s assessment of the nation’s economic situation and an assertion of its economic policies.

Peter Martin, in pre-budget advice, suggested we turn to the government’s “Economic and Fiscal Strategy”, this year on Page 79 of Budget Paper 1.

For what it’s worth this page is copied on this website. It reads like a straight Treasury document, which those with a conservative disposition would find comforting. In the copy I have highlighted references to gender equality, climate change and building people’s productive capacity – references that may not have appeared in a document prepared by the present Coalition. (In government it has been openly opposed to enriching people’s skills, preferring instead to promote a low-skill-low-wage economy.)

Notably the statement commits to “limiting growth in spending until gross debt as a share of GDP is on a downward trajectory”. In this context gross government debt is forecast to hang around 34 to 35 percent of GDP. In comparison with most other countries that level of debt is very low. It’s not clear what’s driving this ultra-conservatism in our government.

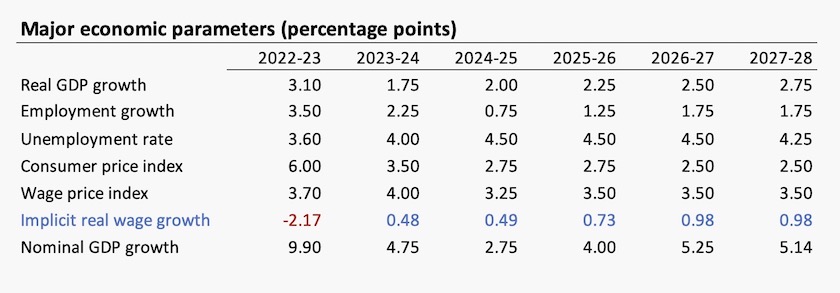

Shown below is a table of the government’s “major economic parameters” – a report on the major figures for 2022-23 and the current almost complete year, and a forecast for the next four years, taken from Budget Paper 1.

Commentators have noted that forecasts for GDP growth in the coming two years, and therefore employment growth, is down by about 0.25 percent on figures presented in December’s Mid-Year Economic and Fiscal Outlook. The world economic outlook has become more pessimistic in recent months, and Australia is not immune. Leading indicators, such as the latest Wage Price Index and a significant rise in unemployment, both released in the two days after the budget, have put paid to the idea that our economy is overheating. (Our forecasts are still more optimistic than those for Japan, the US, the UK and the EU. World growth will depend on just two dissimilar large economies, China and India.)

As is now established practice, Budget Paper 1 has a statement of risks, which may upset these forecasts. Unlike statements prepared by Coalition governments, it has a well-documented statement of risks associated with climate change, and one passing reference to pandemic preparedness. But missing from its risk statement is the possibility of a 1930s-type collapse of the world economic order that could follow the election of Trump as US President. Even now there are signs that the world economic order is giving way to fragmentation: the government’s Future Made in Australia is in part a response to that fragmentation.

The table’s line in blue – “Implicit real wage growth” – tells one of the main stories of the budget. It does not appear in Budget Paper 1, but it is easily calculated from the preceding two lines. It confirms that real wages fell last year, but have picked up a little this year, and should creep up to one percent growth over the next four years.

The other line on the table with a quiet message is the wage price index. Economists are inclined to ignore nominal wage figures, but there is one aspect in which nominal wage rises have a real effect: they reduce the amount of outstanding debt, because debt, including mortgage debt, is in nominal terms. No one expects the government to be crowing about the benefits of inflation, but we might see the results in a lower incidence of grizzles about “mortgage stress” in the next few months, even if interest rates don’t come down.

The real economic story in the budget is about the plans for what amounts to a structural transformation of a scale reminiscent of the transformation that occurred in the 1980s, during the time of the Hawke-Keating government. The plans are laid out in Pages 14 to 27 of Budget Paper 1, under the heading “Investing in a Future Made in Australia”, which provides detail about that initiative. It’s not just about establishing certain manufacturing industries, and it’s not just about de-carbonizing our economy, important as those initiatives are. It’s also about putting our economy back on a path to growing productivity, using public investments to lever private investments, establishing our international competitiveness in areas where we have a comparative advantage, investing in skills, and strengthening our economic security.

The other story is about housing, covered in an entire chapter in Budget Paper 1. It’s less gung-ho, however. It seems to be mainly a repeat of the findings made by the National Housing Supply and Affordability Council, released in the last few weeks (covered in last week’s Roundup.). It is a wicked problem, and while there is plenty of blame to go around, not much can be sheeted onto this government, apart from its reluctance to prohibit “negative gearing” and to re-instate the pre-1991 capital gains taxation arrangements.

Budget politics – the government’s deliberate choice and the opposition’s reversion to form

The government has made a political choice. Concerned with the Reserve Bank’s reaction on interest rates, it could have gone for a tight fiscal policy, with no net spending beyond the already-promised income tax cuts.

If it accelerated interest rate reductions that would have been of benefit to those with high mortgage commitments – perhaps around a quarter of households, depending on what constitutes a high mortgage.

But its chosen path was to go for a mildly redistributive approach, which will be of some benefit to most of the population, particularly young people. In terms of equity it makes more sense to benefit the majority, rather than the minority who have become financially overcommitted.

On Schwartz Media’s 7am podcast on Wednesday – The pitches from budget critics: How do they stack up? – Paul Bongiorno discusses the politics of the budget, and explains the lines taken by some of its critics.

The opposition’s criticisms make little sense. It lacks any feasible economic policy, and every statement it makes exposes its economic hypocrisy. The idea that the Liberal Party is standing for the interests of the working-class battler while Labor is enriching Gina Rinehart and Andrew Forrest is the script for a satirical review rather than serious political debate. The planned tax breaks go to corporations, not individuals, and they are designed to encourage investment, rather than immediate payouts to shareholders. It has been the Coalition’s policies – on capital gains tax, on blocking resource rent taxes, on inheritance taxes, on carbon pricing – that have enriched billionaires.

David Pocock has made the valid criticism that instead of a $300 electricity rebate, the government should spend the same amount – about $3 billion – helping households to electrify their houses. It’s a valid point: electricity bill relief sends the wrong message because it dampens the price signals that would otherwise encourage households to invest to save energy. In this budget the government has taken the rebate course because the CPI has become so influential in public policy. But over the longer term it is disappointing that the government is doing so little to help households manage their energy consumption.

Dutton’s budget reply, confirming that the Coalition has learned nothing

Dutton’s budget reply was a little more coherent than Angus Taylor’s budget comments (no hard task), but it would have disappointed anyone hoping that the Coalition may have an economic policy to deal with Australia’s structural problems.

He set the tone at the outset. Our economic problems have arisen “because this Labor Government has made life so much tougher for Australians, because this Labor Government has set our country on a dangerous course”.

It would have been unrealistic for him to admit that the government we elected two years ago has been dealing with the recovery from the pandemic, a deteriorating world situation, and above all the failure of a long period of Coalition governments to deal with our structural vulnerabilities.

He could, however, have started with “This government has been slow to tackle the economic problems faced by Australia”.

But he was unable to resist negativity. Why did he state upfront that the Voice referendum “divided the nation”? Surely his political minders would have warned him not to remind the nation of his deceitful and divisive referendum campaign.

Then he went on to energy, confidently asserting that Labor’s “renewables only” policy is responsible for electricity price increases. There are two lies in that assertion.

But they have the solution – nuclear power – revealing a complete ignorance of the economics or engineering of energy. In the same vein they will abolish those horrible vehicle emission standards: everyone should have the right to have a large truck belching CO2 and churning up our roads. Not a real policy, but a repeat of John Howard’s pitch to “aspirational” tradies.

Then he went on to housing, with muddled ideas about immigration, confusing permanent and temporary migration, and some notion that foreign students are the problem. Again the Coalition has the answer. It is already recommitted “to allowing Australians to access up to $50,000 of their super to buy their first home”. A demand-side solution that will worsen housing affordability, worsen intergenerational inequity, and load future governments with a bigger age pension bill. As the Reserve Bank warns, there is no quick fix to our housing problem: it has been many years in the making. But Dutton knows better.

Finally on to law’n’order. Crime will be wished away ‘coz the Coalition will keep us safe. It will even abolish anti-semitism.

In Trumpian narrative lacking logic or evidence, but rich in hypocrisy, he used immigration to connect housing shortages and crime.

It’s clear from that speech, which would have been carefully prepared, that the Coalition has learned nothing from the long- term decline in its primary vote, the loss of seats in its former heartland, and its 2022 general election loss. It is so convinced of its innate economic competence that it doesn’t understand how its policy of “small government” and suppressing wages has brought on our present economic problems. It cannot extricate itself from its hostility to renewable energy and its approach to climate change as an issue in identity politics.