Economics

Inflation is now dangerously below the Reserve Bank’s comfort zone.

The ABS Consumer Price Index Indicator for June was 124.2. For July it was also 124.2.

It’s hardly a mathematical challenge to point out that inflation between June and July, as revealed by this index number, was zero. That’s two percentage points below the bottom of the RBA’s two-to-three percent comfort zone. An inflation measure like that points to the need for an immediate reduction in interest rates.

OK, it’s pretty rough to draw a conclusion based on the movement between two figures, each of which includes sampling error, but the point is that when we try to look at what inflation is now, we get a lower estimate than when we look at the rise in this indicator over the last 12 months. That rise – 3.5 percent as widely reported – is influenced by movements in this indicator in the final five months of last year, which is not a sound indicator of how prices are moving now.

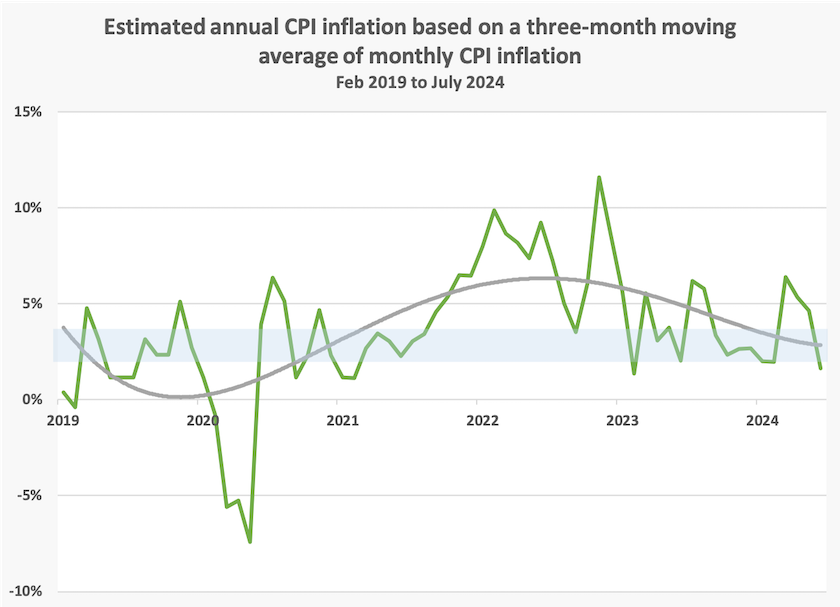

Below is plotted a three-month moving average of this indicator (in green), overlaid with a polynomial (4 order) trend line (grey), going back to 2019. The moving average comes to a rise of 1.6 percent, while the trendline is plonk in the middle of the RBA’s comfort zone.[1]

Even if one is guided by the twelve-month indicator, it is notable that most of the high rises have been in items that have little to do with excess demand in the Australian economy – the sort of inflation that should be addressed with a strong fiscal or monetary response. There was a 7.2 percent rise in “alcohol and tobacco” prices, resulting mainly from increases in excise rates. Housing rents were up by 6.9 percent, a rise attributable in part to rises in interest rates. Automobile fuel was up 4.0 percent, thanks to Vladimir Putin. Insurance and financial services, and fresh fruit and vegetables, are up (6.4 percent and 7.0 percent respectively): these have to do with weather, and climate change.

One notable item is a 5.1 percent fall in the electricity index number. The ABS explains how this fall relates to the various Commonwealth and state electricity rebates, some of which came into effect or were made more generous in July. It is doubtful if the governments will get much kudos for this reduction, however, because in many households, and even in some media, the discussion is about the size of the bill, rather than the price of electricity. The effect is more likely to be experienced by households when their bills for spring come, by which time the full Commonwealth rebate will start to be paid.

Writing in The Conversation Peter Martin draws attention to other indicators showing that inflation in Australia is falling quickly, as it is in other countries. His main point is that even though it seems to have locked itself into a hard line on holding interest rates, the Reserve Bank is coming under increasing pressure to cut rates before the year’s end. Global financial markets are interlinked, and in the US the Fed rate-setting committee is almost certain to cut rates when it meets in mid-September, and will probably make further cuts by the end of the year: Stand by for interest rate cuts: the US is about to start, so expect Australia to follow.

1. Lest anyone think I am selecting data to suit a message, I have been using the same chart in these roundups for many months, updated by the single monthly “all groups” index number. ↩

Chalmers on Labor’s economic policy

Treasurer Chalmers used the Curtin Oration – Patterns of progress – as an opportunity to outline the government’s economic policy.

Much of the media cover of his speech has been about his scathing criticism of Peter Dutton as one whose political tactic is to set Australian against Australian on policy issues, as one who embraces divisiveness. That is hardly news to anyone who is well-informed politically, but it is notable that government ministers have been more vocal in recent times in identifying Dutton’s divisive and polarizing behaviour.

Chalmers sings their praises

Dutton’s supporters are already accusing Chalmers of mounting a personal attack on Dutton – ”playing the man and not the goal” to quote The Australian’s headline. But the criticism is aimed at Dutton’s chosen behaviour, not at his character. It’s a behavioural choice with dangerous consequences, as Chalmers points out, and it means that the opposition is not filling its role of holding the government to account on public policy and offering alternative policies.

As one may expect from a treasurer, Chalmers used his speech to talk about the positive aspects of the economy over the last two years – strong growth in employment, a budget brought back to a fiscal surplus, a small but now discernible recovery in real wages, and solid progress in tackling the inflation it inherited from the Coalition. Housing didn’t get much mention.

No surprises there.

He also described the way the Australian economy has changed since the time of the Curtin-Chifley government, in three distinct phases, with reference to the various shocks that governments have dealt with over those 80 years. We are now in a fourth phase, in which the policy emphasis is on the transition to renewable energy, and on technology, human capital, and the care economy. Mostly no surprises there either: one would expect any social-democratic government to attend to these matters.

But it is notable that he mentions the “care” economy. It was not long ago that governments’ economic focus was almost entirely on the physical economy – agriculture and manufacturing in particular – while the service sector was something that could look after itself, and functions like aged care and health care were seen as unproductive overheads to be carried by the productive sectors.

Also the emphasis on the energy transition is a sharp point of differentiation from the Coalition. The government must be concerned to read of surveys revealing that people believe the Coalition’s lies and misinformation about their superior economic management ability and that they generally credit the Coalition with more economic competence than Labor. The July Redbridge public opinion snapshot revealed that older people, and people with less education, seem to have more faith in the Coalition’s economic policies than in Labor’s.

That is why, in an ABC AM interview on the morning after his speech, Chalmers took a strong swipe at Dutton’s economic credentials, when he said “He likes to pick fights on national security because he has absolutely no ideas on economics”, and that he “hopes nobody will notice he is hopeless on economics”: Chalmers lashes Dutton . (7 minutes)

It is easy for Chalmers and other ministers to spruik the government’s economic credentials among those who have a basic understanding of economics, but Chalmers and all the government’s ministers have to reach a wider, less-informed, audience.

Voters need to realize that the economic performance of the Coalition governments that held office for most of the time between 1996 and 2021 was abysmal. They almost entirely neglected structural reform, allowed our productivity to fall, failed to invest adequately in human capital and physical infrastructure, ignored the economic challenge of climate change, left the economy vulnerable to unstable commodity prices, and re-fashioned the tax system to favour housing speculation while discouraging long-term investment. That’s why many Australians are now finding it hard to make ends meet.

That’s the message the government has to get to the community at large, and not just to people who read the Treasurer’s speeches.

Widening the gap

Public arguments about the equity consequences of government policy, such as the tax cuts that came into effect last month, are often focussed on income distribution. There is generally less attention paid to wealth distribution, however.

That’s because disparities in wealth distribution take time to build up: they generally result from the accumulation over many years of small inequities in income distribution. It’s also because data on wealth is hard to obtain: our accounting and statistical systems are well-adapted to measuring financial flows, but not to measuring asset values, which are conceptually and practically harder to measure.

Just as wealth inequality takes a long time to build up, it is more enduring than income inequality, and as Thomas Piketty reminds us, it has its own positive feedback loop that allows it to go on widening. By contrast income inequality can be dealt with by measures with immediate effects, as occurred during the Covid pandemic.

Contributing to our knowledge of wealth inequality Anglicare has produced its Widening the Gap report, which examines trends of wealth inequality over the last twenty years.

Wealth inequality has widened, and it’s not only because the market value of people’s homes has risen. The big rises have been in “other real estate” (so-called “investment properties”), shares, and superannuation balances.

Summarising the research Anglicare Director Kasy Chambers says “Our research also shows that inequality has been turbocharged by tax breaks that help people who are already wealthy build big superannuation balances, property portfolios, and investments”.

The two main drivers of this widening gap are concessions for superannuation, which tend to favour the already well-off, and a capital gains tax system that rewards idle speculation. Chambers calls on the government to tax income from investments fairly (as was the case before the Howard government changed the capital gains tax system to privilege speculation over investment.) Chambers draws attention to the perverse incentives in our tax system:

People who earn income from work are paying more tax than people who earn income from their wealth. That needs to change if we want to make our tax system fairer.

Universities – foreign students and funding

On Tuesday the government announced its plans for controlling the number of international students enrolling to study in Australia. The stated purpose of the proposed legislation is “to strengthen the integrity of the [higher education] sector and ensure it maintains its social licence”. It is particularly concerned to deal with some of the shonky non-university course providers.

On the ABC’s Breakfast program Vicki Thompson, CEO of the Group of 8 Universities (the 8 oldest universities in the mainland state capitals and in Canberra) speaks of her disappointment at the government’s proposals. She supports the principle of cleaning out shonky operators, but she notes that the cuts will also hit the Go8 universities hard, because they have disproportionately high enrolments of international students. Because they have been subsidising other activities from the profits of foreign students, there will be less funding for Australian students and for research.

Writing in The Conversation Andrew Norton of the ANU (one of the Go8) provides details of the cuts as they apply to various categories of education providers: The government will cap new international students at 270,000 in 2025. But this number may not be reached. Not all courses or providers will be capped: there is no cap on postgraduate students for example. Our non-Go8 universities will be able to expand their offerings to enrol, but because of prestige and lifestyle attractions those universities could find it hard to attract students. Wagga just doesn’t have the same international reputation as Sydney.

UNSW concourse

The ABC’s Maani Truu and Jake Evans provide some hard data on the numbers involved: The true scale of Australia's international student industry — in four charts. One of those charts shows the strong growth in “vocational education and training” since 2022. They also provide compelling evidence that foreign students are not contributing to pressure on rental markets.

The legislation will go before the Senate, where it is likely to be confronted by an unholy alliance between the Greens who will go for a utopian outcome, and the Coalition who will relish any chance to hurt the universities financially. Its likely eventual passage will hardly touch on more basic issues in tertiary education.

Business models based on cross-subsidising one group of customers from the surplus gained from another group are generally not sustainable. This is particularly relevant for our universities, now competing with high-quality Asian universities. Also, some Australian universities have been attracting students who have been unable to get into their own highly-ranked universities. This has surely resulted in some lowering of grades.

The overriding issue is our willingness to invest in educating our own students. Melinda Hildebrant and Peter Hurley of Victoria University, writing in The Conversation, ask how we are going to meet the government’s target of having at least 80 percent of working age people with a university degree or TAFE qualification by 2050: How is “Gonski-style” needs-based funding going to work for universities?. The financial barriers before the most disadvantaged students are too high, and those who do get to universities are disproportionately failing to complete their courses.

Writing on the ABC website Shalailah Medhora reports that, as a result of the changes introduced by the Coalition’s Job Ready program, many courses have become absurdly expensive. That idea of tailoring student support to courses filling immediate skills needs was based on too narrow an idea of the purpose of education.

We need graduates in engineering, geology, the health professions and so on, but without a rounded education, including content from outside their specialized disciplines, these graduates will lack the creativity and flexibility to cope with a changing world.

Dumb electricity meters

Imagine a different way to buy gasoline. There are pumps at the garages, but they have no display of price or quantity pumped. You don’t pay at the counter. Instead, every three months you get a bill telling you how many liters you have bought. You may be shocked to find that you filled up on a day when the Singapore “MOPS85 Petrol” price benchmark, the reference price for Australian gasoline was high: you should have looked that up before you filled up.

That’s essentially what the electricity market looks like, or what it is becoming, with “flexible tariffs” or time-of-day charging.

As we move to renewable sources for electricity generation, it makes good sense if we shift our use of electricity to times when it is plentiful – when the sun is shining and the wind is blowing. We should heat our hot water in the middle of the day, and should avoid putting too much demand on the grid in the early evening, when, for the next few years at least, electricity supply has to be supplemented with expensive gas peaking plants.

The best way to achieve that matching of demand and supply is through charging different prices for consumption at different times of the day, which is why, by 2030, every customer will be charged for their electricity according to the time they have used it.

In fact, as the ABC’s Daniel Mercer explains, many customers have already been moved to such a tariff structure, but they haven’t realized it until they have received their first bill: Power price structures have radically changed, but nobody thought to tell consumers about it.

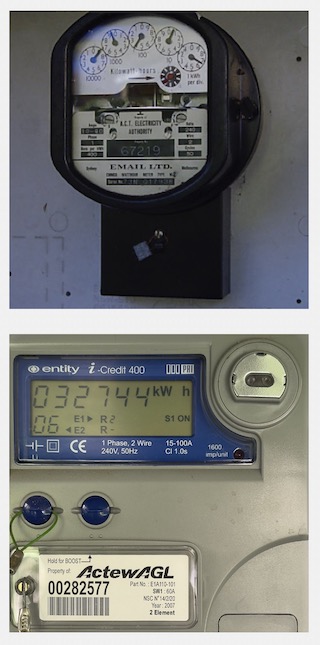

This shift has been made possible because the electricity companies have been replacing our old meters, like the one pictured on the top, with so-called “smart” meters, like the one pictured below it.

These meters are called “smart”, because using a technique called “powerline communication” – a technology developed 60 years ago – the power companies can read these meters remotely.

You can too, but only if you’re happy to go outside and read the meter. If you want to know how much power you’re using you can read the meter in, say, five-minute intervals, and with some arithmetic you can work out your power consumption. To help you AGL has a website Read your own meter, patronisingly explaining how to do it, written as if they are explaining some marvellous new customer service.

In fact for the customer these meters are actually dumber than the ones they replace, because the old meters had a little spinning disc (the rotor of a small induction motor), which gave you a pretty good feeling of your consumption. If it was spinning quickly, it may be because your hot water booster had come on.

A proper “smart” meter would connect to your home Wi-Fi, so that you could monitor your consumption and the price you’re paying for it on your cellphone or computer. That’s how markets can and should work – you, the customer, would be well-informed, and would be in a better position to control your usage. But instead what is intended is simply a continuation of the old patronising business model, of the dumb customer without any agency.

The idea of linking these meters to the internet is not some theoretical model: in England, a country which has generally lagged Australia in the uptake of domestic information technology, their “smart meters” have this capacity.

This is not just an issue in consumer convenience and ways to avoid large bills. It’s also about our ability to make the best use of renewable energy. Without well-informed consumers responding to easily-available price signals and knowledge of their own consumption, the electricity market will fail to meet our emission reduction goals, and we will all be paying too much for electricity. This is stressed by Tony Wood of the Grattan Institute in his post How to fix the electricity market. His piece is in the context of an upcoming review of the National Electricity Market (NEM), and he stresses that consumers must be involved in that review.

A similar point is made by Energy Consumers Australia in their submission to the review (neatly summarized by Daniel Mercer in another article on the ABC site), which includes a sharp criticism of the way the NEM was designed by economists based on an Economics 1 model of how markets work. The designers were guided by the ideas that prices should reflect cost, which is a misinterpretation of the more basic economics principle that prices should contribute to the best allocation of scarce resources. Reliance on this broader principle (rather that the undergraduate “cost-reflective” principle), could result in a much fairer pricing structure, lower electricity bills for all, and more rapid progress to our emission-reduction goals.

The geography of nuclear power

Most Canadians live just north of the 49th parallel. Ontario juts down south a little: the conurbation around Toronto lies at around 44 degrees.

That’s the same latitude as the southern tip of Tasmania. The rest of Australia lies in lower latitudes.

And that’s why, as a source of zero emission electricity, nuclear power is a good idea for Canada in a way that it’s a bad idea for Australia.

On the ABC’s 730 program – Nuclear power: can we learn from Canada? – and on ABC RN – Ontario’s nuclear energy sector growing – Ontario’s conservative premier, Doug Ford, spruiks the benefits of nuclear, in an apparent endorsement of the Coalition’s nuclear policy. (Perhaps, like Peter Dutton and Ted O’Brien, he too finds geography a tough subject.) Ontario already has large conventional reactors, providing more than half of that province’s electricity, and is building at least one small modular reactor.

These ABC segments raise common concerns with nuclear power – safety, cost and waste.

The emphasis is on waste: Canada has an accumulating pile of waste and as yet has no long-term storage solution. The issue of safety is addressed with presentation of a lady walking her dog along a beach within a kilometre of a nuclear power plant. Cost is addressed only in passing, however.

There is a risk in Australia that proponents of nuclear will also be talking about waste and safety, as bait for opponents of nuclear to direct their energy into these areas rather than the prohibitive cost of nuclear power, particularly in a country on track to provide 100 percent renewable power.

Concerns about waste and safety are easily dismissed. In comparison with other forms of generating electricity, nuclear energy is very safe. The disposal of nuclear waste is a serious issue, but in a democracy, where future generations don’t vote, it’s a problem the electorate is ready to kick down the road, particularly if they believe it’s a minor problem associated with delivering cheaper, green power.

The July Redbridge public opinion snapshot revealed that 54 percent of respondents believed that “the Albanese Government’s renewable energy policies and timelines are pushing the costs of energy through the roof” (only 20 percent disagreed), and that the public are warming to the idea of the Coalition’s nuclear energy policy.

That’s why it’s important for economists to keep the focus on the economic idiocy of the Coalition’s proposal, and for geographers to remind us that latitude counts in energy policy.

Superannuation: poor management and wage theft

Most workers soon realize something’s wrong if their wages don’t get paid. But with superannuation contributions it’s a different matter. If, because of error or deliberate lawbreaking, an employer doesn’t contribute a worker’s 11.5 percent superannuation, only the most vigilant worker will notice it hasn’t been paid.

The consequences down the track of unpaid superannuation are significant. A 25-year old worker, with a wage of $80 000, should enjoy about a $9 000 contribution to his or her account. For that worker, each year of such contributions, if deposited in a growth fund paying a 5 percent real return, will accumulate to a lump sum of around $60 000 at age 65.

The Super Members Council has published a well-researched report on the incidence of unpaid superannuation: Fixing unpaid super: Making super fairer for workers and employers alike. They find that the incidence of unpaid superannuation is falling: in 8 years it has fallen from 9.3 percent of the Superannuation Guarantee base to 6.7 percent. But because the base has been rising, the shortfall has been rising: it amounted to $5.1 billion in 2021-22. In that year 2.8 million workers missed out on all or some of their superannuation entitlements. That’s around one in four workers.

They find that people in insecure work, lower-income earners, migrants, and younger workers are most likely to be underpaid, and that women were over-represented among the most affected.

Shortfalls in superannuation payments can result from poor payroll management, insolvency and deliberate wage theft. The Council does not try to trace the relative contributions of these factors, but it notes that a lack of synchronization between regular pay and superannuation contributions can contribute to underpayment.

Most workers are paid fortnightly, while superannuation is required to be paid only quarterly. Large enterprises generally synchronize superannuation and wage payments, but many small businesses pay only quarterly. In fact some small businesses use their superannuation liabilities as a source of working capital, with consequences for employees if the business goes broke. That is why the Council is urging the government to get a move on in implementing its “payday super” promise, which will require the synchronization of superannuation contributions and wages. The Council is also calling on the government to make use of the Tax Office’s capabilities to improve enforcement.

For those who seek to confirm that their employer is paying superannuation, the ABC’s Hanan Dervisevic has a useful guide in an article: Are you being paid superannuation correctly by your employer? Here's how to find out.