Other economics

CPI inflation – let’s not get too worried

Both the quarterly CPI for March, and the monthly CPI Indicator suggest that annual inflation, as indicated by the CPI, is around 3.5 to 4.0 percent, and is on the way down.

The March quarter CPI always has several one-off measures, including a re-setting of the Pharmaceutical Benefits Scheme safety net (which results in a surge in health prices) and higher school fees associated with the start of the school year. The ABS seasonally-adjusted series, which should smooth out these effects, is more informative than the headline figure. The seasonally-adjusted CPI rise, from December 2023 to March 2024, was 0.88 percent, which, if annualized, would come to 3.57 percent. This is shown in the graph below.

Much is being read into the small uptick in the latest quarter, and the implication of the outcome being 0.1 or 0.2 percent above market expectations. Maybe those who read so much significance into these details could do well to do a course in statistics, or better, some field work in gathering data.

Annual inflation slows to 3.6 per cent after higher than expected price rise in March quarter rules out rate cut hopes is the headline of the ABC’s Kate Ainsworth’s account of the CPI data. Fortunately her article is less categorical than the headline: the Reserve Bank is a little more sophisticated than an automaton responding to the headline figure. Quite apart from seasonal factors, filtered out in the graph above, there are non-seasonal factors contributing to this result, such as ever-rising insurance premiums, and rental price increases. These should be disregarded by the Reserve Bank because its concern is, or should be, about making sure inflation doesn’t feed back on itself, to become “accelerating”.

Higher insurance premiums certainly contribute to the CPI, but they are not accelerating. Rather they’re a price rise, resulting largely from climate change, to which we must adjust. Rental price increases contribute to the CPI, but the very mechanism the RBA uses to control inflation – higher interest rates – can contribute to rental price inflation. In the short term heavily geared property owners, in a suppliers’ market, may feel compelled to raise rents to cover increased interest rates. And in the medium term higher interest rates have a dampening effect on building construction, and therefore lead to a restriction on rental supply.

Consumer concerns – electricity metering

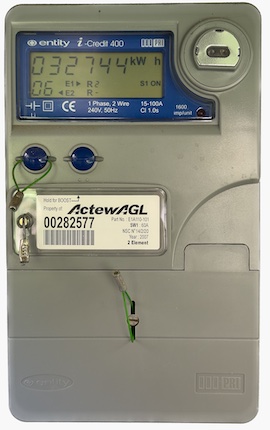

There was a time when an electricity meter looked like the one pictured alongside. Mechanically it was a magnificent device, with a little spinning wheel, driven by an induction motor, which in turn drove a set of reduction gears to show tens of thousands of kWh, thousands, and so on, down to units.

Its function was simple – to measure the number of kWh of electricity consumed, and customers were billed accordingly at a standard rate per kWh. Many households also had a separate electricity circuit with its own meter, linked to an equally intricate timer, which provided electricity at a lower price in the small hours of the morning, to heat hot water.

These were the days of 24/7 “base load” electricity, generated from large coal-fired stations, when there was a heap of spare capacity after people went to bed.

The world has changed. Now, thanks largely to the high penetration of “roof-top” solar, electricity is plentiful around the middle of the day, and as base-load coal and gas generators close, electricity is becoming scarcer at night. Small and large scale storage will help provide night-time supply, but storage is expensive. It is therefore sensible to get consumers to shift their use to the daytime – when the sun shines and the wind blows.

So for the last few years there has been a roll-out of so-called “smart” meters, like the one pictured, which can record how much electricity is used at different times of day, allowing utility companies to set charges accordingly – a low price in the daytime, and a high price at night – sometimes with a particularly high price at times of peak early evening demand.

That all aligns with standard textbook economics – demand being rationed through prices. But it is also a basic assumption of the economic model that people know what they’re buying, and know how much they’re paying for it. That is not always the case.

Taking advantage of the capacity of smart meters, some retailers have been switching customers to time-of-use tariffs, apparently not telling them about the change. They learn about the change only when they get their bill, according to a story on the ABC website by Daniel Mercer and James Wakelin Energy companies under fire over move to “punishing” time-of-use tariffs. Daniel Mercer also has a later article reporting that the Australian Energy Regulator admits to serious concerns over time-of-use tariffs.

It isn’t that the AER is opposed to time-of-use tariffs, but, along with consumer groups, it is concerned at the way they are being implemented. Most consumers aren’t ready for the change. In fact most people haven’t got a clue about how they are paying for electricity.

In teaching consumer economics, lecturers ask students to write down their estimates of the price of a litre of gasoline, a litre of milk, and a kilowatt-hour of electricity. They do pretty well on the first, not too badly on the second (with some gender bias), and on the third the usual response is “what’s a kilowatt hour?”. These responses are from young people who are concerned about climate change and its effects.

Even those who do know about how electricity is priced aren’t helped much by the “smart” meters, because those that are routinely installed have no capacity to tell customers their real-time use or costs being incurred. (At least with the old meters one could see how fast the little wheel was spinning to get some idea of immediate consumption, but even that is opaque.)

Technically it should be possible for the electricity companies to link metering to the internet, so that people can monitor use on their phones and see, for example, how much cost they have incurred in the last hour, today so far, and so on so that they can adjust their behaviour with minor changes – for example a timer switch plugged into the socket for the dishwasher. It should also be possible for individual customers’ information to be available to electricity companies, so that they could warn customers of early signs of high charges. That’s how a market should work.

But that’s not possible, because the “smart” meters are actually dumb: mostly they’re simply electronic versions of the old meters. We have lost an opportunity to make the electricity system work to the benefit of consumers and the environment.

That’s because privatization saw the end of innovation in metering. Sixty years ago, well before the internet, old and much-maligned government utilities had developed technology that allowed for remote meter reading (using high-frequency transmission over power lines.) But innovation stopped with privatization, because privatization included hiving off retailers into separate entities, with a concern simply to see that people pay their bills. The retailers don’t even read the meters themselves: they generally contract that out, often to the distribution companies, whose profits directly relate to the amount of electricity is consumed, regardless of when it is consumed.

The fundamental problem lies with the drive to privatization. Had transmission and metering been kept in publicly-owned utilities, they could have developed more consumer-friendly technologies, allowing the benefits of price signals to operate as economists intend. The zealots who drove privatization, however, forgot the basic economic principle that the effective use of price signals, rather than the ownership of businesses, is what drives efficient resource allocation. Privatization, when pursued as an end in itself, can often lead to worse market outcomes.

Consumer economics – confusopoly

The term “confusopoly” was coined by Scott Adams, the cartoonist who brought us Dilbert. He defined it as a business practice of intentionally confusing customers rather than competing on price. Economist Josh Gans of the University of Melbourne brought confusopoly into the economics lexicon in a presentation to the ACCC The road to confusopoly.

??????????

The consumer organization Choice has brought confusopoly to our attention in a short article Unclear supermarket “specials” are confusing shoppers, with illustrations of the ways supermarkets use terms such as “discount”, “while stocks last”, “price dropped”, “special” and so on, and the way consumers understand these terms. The short answer is that most consumers are confused, confirming that confusopoly is alive and well.

One of the basic principles of economics is that prices work to allocate resources efficiently when those prices are clearly understood by consumers, who engage in a rational decision-making process.

One theory, developed and verified by behavioural economists, is that sellers deliberately work to overload people’s capacity to think rationally and coolly. Confusing price signals are but one weapon in their armoury, which includes use of bright and clashing colours, music, and a layout that defies logic (why are there confectionaries and nuts at the end of the aisle for cleaning products?).

Another seller’s practice is the use of “anchors” to set consumers’ expectations. The banner “Was $12, now $4.99”, is designed to establish in the shopper’s mind the idea that $12 is a reasonable and fair price. So as not to run foul of the ACCC, the $12 price probably did exist at some point – for one day in the supermarket in Mount Isa perhaps.

(The Choice site has a field for readers to add their name to a petition to ask the government to make grocery pricing fair and transparent.)