Other economics

The changing tactics of big business

The ABC’s Ian Verrender gives us an insight into the way businesses adjust to competition law in his article Why our supermarkets and major retailers changed tack on their price-gouging tactics.

In times past the most common violations of competition law took the form of price fixing. He reminds us of the case where Richard Pratt’s private company Visy sanctioned a deal with packaging rival Amcor to create a cartel setting the prices charged for cardboard boxes – and therefore the price of almost everything we buy in retail stores. That cost us $700 million, for which the companies paid the puny fine of $36 million – a small cost of doing business.

As Verrender points out, in comparison with regulators in the EC and the USA, our regulators are weak.

He suggests that for big businesses, however, collusion on prices is going out of fashion. He doesn’t say why: perhaps it’s because of more consumer awareness of price manipulation. He suggests that our big supermarkets and big retailers are using their power as big buyers – known to economists as monopsonistic power – to put pressure on their suppliers.

Anyone who has been involved in the food production chain can attest that our two big supermarkets have always been tough to deal with, and can point to market practices that may not be illegal but certainly break the spirit of competition law.

It is notable that these practices have only recently received public attention. Perhaps it’s because the so-called “cost of living” crisis (actually a “low wage” crisis) has put supermarkets’ practices under the spotlight.

And perhaps it’s because the supermarkets’ legitimate concern with shoplifting has led them to adopt aggressive and intimidating security measures, in which the message they convey, regardless of their advertising spin, is that they treat everyone who comes through their doors as a thief. Mistrust begets mistrust.

Accounting 1 and Woolworths

Accounting students who fail to understand the difference between return on investment and return on equity may be penalized by a poor mark, but perhaps a threat of six months jail is excessive, and such a penalty probably wouldn’t gain the approval of a university ethics committee.

But Australians, fed up with supermarkets, must have enjoyed a little Schadenfreude watching or reading accounts of Woolworths’ CEO Brad Banducci dealing with Senator McKim’s question about the company’s return on equity.

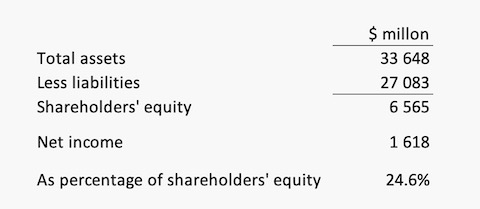

The calculation isn’t particularly difficult. The figures below are all easily obtained from the company’s income statement for 2022-23 and its balance sheet of 30 June 2023, available on Yahoo Finance.

There, that wasn’t too difficult.

We should cut Banducci a little slack for his reluctance to give a categorical answer, because, as shown in the arithmetic above, the shareholders’ equity is a residual, after the value of liabilities is subtracted from the value of assets. The value of a firm’s liabilities is pretty clear, but the value of a firm’s assets is subject to the somewhat arbitrary conventions of accounting, which means the value of equity as a residual is subject to wide interpretation, particularly in a firm like Woolworths which has quite a high debt to equity ratio – something enjoyed by an established firm in an assured market. By the conventions of accounting firms tend to err on the conservative side of asset valuation, a point particularly relevant for a firm like Woolworths with substantial real estate holdings.

Which is all a long way of saying we cannot put too much faith in accounting figures, and in any case shareholders don’t believe in them. Shareholders aren’t particularly interested in a firm’s book value: rather they are interested in a firm’s capacity to go on making profits into the future. Woolworths’ shares are trading at around $30, rather than at their book value of $5.64 ($6 556 billion ÷ 1.214 billion shares on issue.) Earnings per share are $1.33 ($1 618 ÷ 1.214) which equates to a rather ordinary four percent return on equity, but that’s not the full story either.

For those who seek an informed assessment of Woolworths’ profitability, they can find it in an 11- minute session on the ABC’s Drive, where Alan Fels runs through a few simple sums about the company’s performance. Its markup is small but its turnover is huge, and even though its markup is small, it is higher than in some supermarket chains in other countries. The question whether a firm is making excess profits, a sign of inadequate competition, is one best left to competition authorities.

When a firm is making excess profits there is pretty well always some level of consumer detriment, usually in the form of high prices. But the absence of excess profits does not mean consumers’ interests are being served: the syllogism should not be inverted.

A firm may be unprofitable because of straight out inefficiency. In retail industries that can be manifest in poor and wasteful inventory control, wasteful expenditure on advertising, high staff turnover because of bullying by front line supervisors, inadequate investment in technology, use of performance management systems that suppress creativity and flexibility, and straight out incompetence. In some industries where there are only a few firms in the market, competition can be for industry dominance or growth, often resulting in the waste of under-utilized capacity.

Bloated and overpaid management bureaucracies can soak up a firm’s cash flow, reducing its profitability, while providing no benefits to consumers or shareholders. John Quiggin makes this point in relation to supermarkets in a post by the ABC’s Kenji Sato: Market power allows CEOs to raise their own salaries, Queensland economists say. (Selected data on executive salaries is provided, under duress, in firms’ annual reports.) Quiggin points out that the Coles CEO Steven Cain took home $10.2 million last year, while Woolworths CEO Brad Banducci took home $8.6 million.

Not bad for someone who struggles with first year undergraduate accounting.

The IMF’s World Economic Outlook – nothing to get excited about

The IMF’s World Economic Outlook, released on Wednesday, is surprisingly upbeat for that organization. Its first sentence reads:

The global economy remains remarkably resilient, with growth holding steady as inflation returns to target.

Some commentators have focussed on its statement on inflation, and its hint that interest rate reductions are still some way off:

… while inflation trends are encouraging, we are not there yet. Somewhat worryingly, the most recent median headline and core inflation numbers are pushing upward. This could be temporary, but there are reasons to remain vigilant. Most of the progress on inflation came from the decline in energy prices and goods inflation below its historical average. The latter has been helped by easing supply-chain frictions, as well as by the decline in Chinese export prices. But services inflation remains high—sometimes stubbornly so—and could derail the disinflation path. Bringing inflation down to target remains the priority.

This statement seems to have been influenced by the IMF’s forecast for inflation in the USA, which is predicted to be 3.0 percent this year, falling to 2.1 percent next year, which will still be above the US Fed’s 2.0 percent target rate.

The IMF’s predictions for Australia are pretty well in line with those revealed in the government’s Mid Year Economic and Fiscal Outlook, published in December. (An exact comparison isn’t possible because the IMF uses calendar years while the MYEFO uses July-June financial years). The IMF’s April 2024 estimates for growth, inflation, current account balance and unemployment are all more positive than those they made in their October 2023 report.

For Australia it forecasts 3.5 percent CPI inflation this year – down from 4.0 percent in its October 2003 forecast – and 3.0 percent next year. Our RBA target is a band of two to three percent.

The Outlook was written before the Iran-Israel exchanges, which have seen a steep rise in the oil price. That will almost certainly influence our CPI, but it will not necessarily contribute to demand-side inflation, because spending on more expensive oil is spending outside Australia, actually reducing demand in the domestic economy. Paradoxically it’s deflationary, provided it doesn’t set off a round of price and wage increases, but that’s unlikely because we are used to fluctuating prices for gasoline.

It is hard to see anything in this report that should guide the RBA to delay any intentions it may have to reduce interest rates. The ABC’s Ian Verrender in an article on business insolvencies points out that our interest rate increases have been much more effective in taking the heat off the economy than has been the case in the USA (presumably because of the prevalence of fixed-rate mortgages in the USA). To quote Verrender:

While America's economy continues to defy the odds, with stronger-than-anticipated inflation, employment and spending, Australia's economy is labouring under the growing weight of the past two years of rate hikes.

Using data from CreditorWatch, Verrender finds that the number of businesses in external administration have reached a record high. There have been business failures across the board, most prominently in the “food and beverages services” industry.

A rise in business failures is generally seen as a worsening of economic conditions. It could also be associated with structural change. The Australian economy, in common with the rest of the world, is still dealing with changes consequent on the pandemic, and in Australia a change in government has seen some shifts in economic policy.

We will get some indication as to whether there has been greater structural change when the ABS publishes job mobility data in July. Some economic commentators are interpreting the March labor force data, showing essentially an unchanged unemployment rate, as a sign of an overheated economy, but there is not enough in those figures to support such an interpretation. We will get some indication of inflation on Wednesday when the ABS publishes its quarterly CPI and its CI indicator for March.