Industry policy

A future made in Australia: no, it isn’t Gosplan and it isn’t protectionism

Judging by the reaction of some economists, Albanese’s speech A Future made in Australia (covered briefly in last week’s roundup) foreshadowed an intention to adopt Soviet-style central planning in Australia, or perhaps a return to the postwar era of industry protection and import licensing.

The speech is cluttered with political spin and redundancies, the result of its having too many writers, but Albanese gives a clear explanation in a 13-minute interview on the 730 Report, misleadingly titled Anthony Albanese's plan to boost Australian manufacturing – a title that conjures images of factories turning out Pelaco shirts and Holden Kingswoods.

Albanese explains that the government’s aim is to develop “a more resilient economy”, and that will involve two related policies – ensuring we value-add where we can be globally competitive, and will be “building sovereign capability in areas of national interest”. He goes on to mention opportunities around value-adding to our raw materials, and to mention where Australian innovations, such as in solar panels, have seen the commercialization opportunities taken up by other countries.

Neither is, or should be, controversial. Value-adding to mining and agricultural production has been an aspiration of governments of all persuasions ever since Federation, and economists have been referring to the gap between innovation and commercialization for almost as long.

In an interview on The Insiders Treasurer Chalmers hints at the range of measures, including tax changes, the government could use to realize the government’s objectives:

We are prepared to consider the tax system as one of a whole range of levers that may be useful as we pursue a Future Made in Australia and make ourselves that indispensable part of the global net zero economy. But again, what I'm signalling to your viewers is what they will see on Budget night – it will be broad, it will be comprehensive. The tax system may play a part, public investment will play a part, but overwhelmingly what we're trying to do here is incentivise private investment, not replace it.

Albanese’s speech has attracted the usual chorus of hysterical condemnation from the political right. Also there are economists who are wary of anything that can be described as “industry policy”. These include a few neoliberal fundamentalists who believe the government should leave everything to the market, and more reasonable economists who believe that the government should confine itself to areas where there has been market failure.

These criticisms are summarised (but certainly not endorsed) in Michael West’s article PM downplays Commission criticism on manufacturing push. One comment that many have hooked on to, including Michelle Grattan, is a statement by Productivity Commission Chair, Danielle Wood: “We risk creating a class of businesses that is reliant on government subsidies and that can be very effective in coming back for more”.

Back then it really was protection

It’s a fair warning to the government that when it comes to designing specific policies, it should have clear rules about withdrawing support when a project fails, or when it can stand on its own two feet.

That’s design advice, not a criticism.

Wood also points out that the government’s policy could see resources taken away from other sectors of the economy.

In fact the government’s intention is that there should be a redirection of resources. If it means we invest in globally competitive bespoke high-technology manufacturing, green steel, vaccines and hydrogen, rather than in football ovals, casinos and railroads that terminate in swamps, surely that’s an improved allocation of resources.

The government has been clear in explaining that its policy is driven, in part, as a reaction to the US Inflation Reduction Act. There is a school of economic purists who believe that even when competing countries use subsidies, import restrictions, tariffs or manipulated devaluations, governments should resist the urge to respond. In support of this idea the economic catastrophe of the 1930s, attributed to countries’ beggar-thy-neighbour policies, is held up as an example.

Indeed, such a narrative was the underpinning of the Bretton Woods System that established an economically liberal world order. It was a convenient narrative to protect against a destructive prisoners’ dilemma situation of competitive protectionism, but economists such as Barry Eichengreen and Jeffrey Sachs have suggested that the damage resulting from 1930s competitive protectionism may have been overstated.

A most thoughtful comment on the government’s vision is in a post by the ABC’s Gareth Hutchens: Do we want Australia’s economy to be more self-sufficient?. He finds nothing in Albanese’s speech that hints of a return to the old order of protectionism. Rather, it is an adjustment to a changing world order. As Albanese said:

Strategic competition is a fact of life. Nations are drawing an explicit link between economic security and national security. The so-called “Washington consensus” has fractured - and Washington itself is pursuing a new direction.

Hutchens goes on to draw our attention to a 1933 essay by Keynes, who 11 years later was to provide much of the intellectual basis for the Bretton Woods order. Because of that association we tend to categorize Keynes as a free trader, opposed to government policies designed to shape their countries’ economic structure. But as Hutchens points out, Keynes’ ideas were much more nuanced. He understood the pitfalls of economic nationalism, but he also respected the right of governments to shape their economics, including the decision about “what, broadly speaking, shall be produced within the nation and what shall be exchanged with abroad”.

With the benefit of hindsight we can criticize industry policies of the past, pointing to the cost of protectionism as it lingered into the 1960s and 1970s, while forgetting that in its original inception, up to and around Federation, protectionism was the policy that helped Australia develop as a democracy with a prosperous middle class. As Ian McLean of Princeton University points out in his 2012 book Why Australia prospered: the shifting sources of economic growth, we chose that path rather than the destructive free trade path of Argentina – a country that started the twentieth century with the same opportunities as Australia. We were mistaken in having held on to that policy past its use-by date, a point implicit in Woods’ warning, but not in having had it in the first place.

In any event it is quite unreasonable to portray the government’s Future made in Australia as protectionism, because at its base it is about correcting a huge market failure. That is the failure of the doctrine of comparative advantage, which, in essence, says we should stick to digging up stuff and selling it to the Chinese, and they should stick to making it into cars and solar panels. We have seen what commodity dependence did to Nauru, is doing to many African countries, and is doing to Australia.

Commodity dependence has brought us a volatile exchange rate that periodically wipes out our trade-exposed industries. It has brought us a distorted financial sector, where our stock exchange is dominated by banks and mining companies – both extractive industries rather than wealth-creating industries, to use Mariana Mazzucato’s classification in her work The value of everything: making and taking in the global economy. It has brought us under the political domination of the fossil fuel industry, which has used its political clout to thwart a resource-rent tax and to delay our transition away from fossil fuels.

And it has brought us a lazy business culture, in which there are greater rewards in securing economic rents, in tax avoidance, and in land speculation, than in doing anything useful. For 236 years we have had the easy returns of a “settler economy”, with high returns to investment – much higher than those in more established “developed” countries. As is pointed out in the annual Credit Suisse Global Investment Returns Yearbook, over the last 122 years Australia has had the second-highest return to equity out of 25 countries – pipped to top place by South Africa, another “settler economy”.

We now have an economy sloshing with money, but it’s in the hands of those who won’t invest it unless they can be assured of the high and short-term returns enjoyed in the past. That expectation was given a lease of life by the Howard government’s 1999 tax changes, rewarding speculation over long-term patient investment, and that has inflated our housing bubble.

That’s the massive market failure our government has an opportunity to correct.

The hard numbers of our energy transition

Alinta Energy CEO and Managing Director Jeff Dimery, in a speech at the National Press Club, has taken us through the hard numbers of our energy transition.

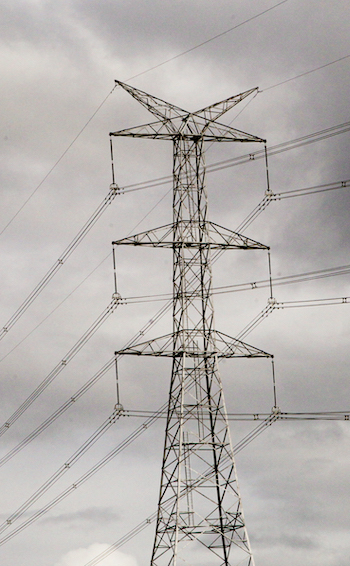

He supports the energy transition “100 per cent”, but warns that we need a huge investment to achieve that transition. While there is progress on household and grid-scale solar generating capacity, there is slow progress on storage to make that electricity available through the 24 hour demand cycle. We need more of everything involving storage – household batteries, grid-scale batteries, and big pumped-storage. As a result much of the electricity Australians generate is already going to waste. Also there is the need for new transmission lines as indicated in the AEMO Integrated System Plan.

We have knocked off some easy tasks, but from now we face increasing costs. To quote Dimery’s summary on costs:

Australians will have to pay more for energy in the future. We will spend more as a percentage of GDP on energy, energy services, and energy infrastructure. Whether we pay through the tax base, or pay the large upfront costs of an EV, or batteries and solar… or we’re paying more for electricity from the grid – we’ll all pay more in aggregate.

We need to be honest about that.

And, I don’t think the average Australian is prepared for that reality.

It’s easy to summarize that statement by saying that Dimery is predicting a huge increase in your electricity bills, but that would be misleading. As he says there are different ways to pay, and they aren’t necessarily through your bill.

It should be a public good

The ABC’s Jane Norman has an excellent article on Dimery’s speech, including some context, such as a reminder that the investment required between now and 2050 is an eye-watering submarine-scale $383 billion, and a reference to the distraction of nuclear reactors as an option to renewables: they’re too expensive and take too long to build.

It’s unfortunate, however, that the headline on Norman’s article is “Your power bills are going up, according to one energy boss. Here’s why”. And it has a portrait of Dimery looking like the headmaster of an English boys’ school about to announce a collective punishment. The ABC needs to take more control of its headlines, because they can have more impact than the professionally-crafted articles they cover.

Dimery explains that much of the cost of providing electricity – about 45 percent of the average bill – is in network charges. That is paying for the high and low voltage lines, switching yards and transformers that come between power sources and your house or business connection, and we need to make big investments in this infrastructure.

There is no sound economic reason why an expanded network, or even the existing network, should be paid through our bills. Because the network has to be committed and built well in advance of expected demand, the investment made is not dependent on the price signals in our bills – except, perhaps, in the very, very long term. Once built it’s a sunk investment, and it’s a natural monopoly. Like an interstate highway, the network has many characteristics of a pure public good.

It would make sound economic sense for the Commonwealth to own the network as a public asset, financed by borrowing. That would take advantage of the Commonwealth’s comparatively low cost of capital, saving the costs of regulating a private monopoly and the excess profits allowed to private and corporatized owners of our present network. The same logic applies to large pumped water storage facilities.

That would spread the cost of our energy transition to all taxpayers, and would ease the load on those least able to pay, while allowing price signals to play their part in charges relating to electricity usage.

A carbon price – well, sort of

John Quiggin has a Conversation article Australia now has a $70 “shadow price” on carbon emissions. Here’s why we won’t see a real price any time soon.

Does this mean that at last we are to have a price on carbon – at $70 a tonne, or three times the short-lived (and effective) $23 price we had between 2011 and 2014?

Not really, explains Quiggin. He explains that we are still muddling-through with modifications of the Coalition’s “direct action” scheme.

The $70 is the price to be included whenever the Commonwealth performs a benefit-cost analysis of projects, or calculations of the economic costs and benefits of rule changes.

If it’s an appropriate figure to be used in that context, then why doesn’t the government simply set a carbon price of $70 a tonne, and leave the details to the market? The answer lies in the political history of carbon pricing, which Quiggin covers in his article. It’s a story of good policy wrecked by a prime minister who has gone on to burnish his credentials as a world-renowned climate change denier.

Electric vehicles taking off?

Have you been noticing a few more electric vehicles on the road?

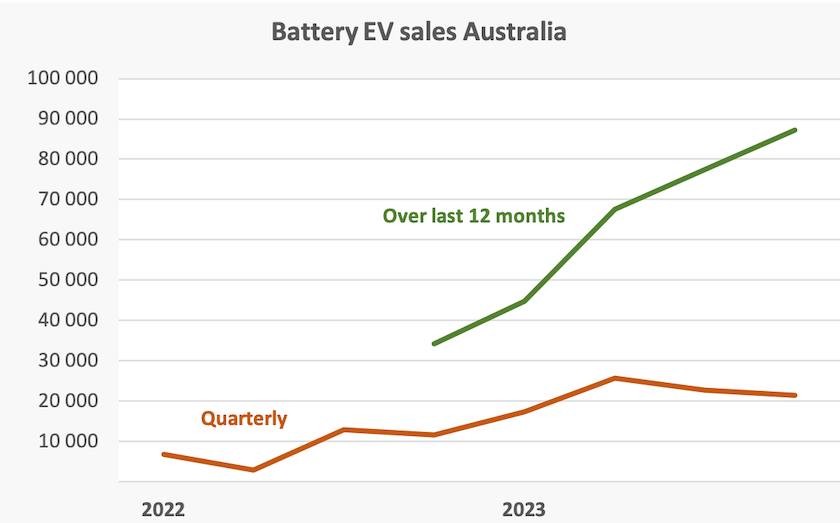

It takes a little digging through Australian Automobile Association data to get a time series of electric vehicle sales but by now there are eight quarters, or two years of data. Each year Australians buy around a million passenger motor vehicles, and it looks as if battery electric vehicles are rising towards 100 000, as shown on the graph below.

Those lines look like a linear progression, but in fact the growth of EVs is likely to follow a logistic function which resembles an exponential growth in its early stages, before there is saturation. The World Resources Institute finds that once EVs achieve a market share of one percent, sales accelerate, and we reached that point about a year ago. In the leading country, Norway, EV sales are up to 70 percent, and show no sign of slowing.