Economics

The Human Development Report: “We can do better than this”

The UNDP Human Development Report is summarized in its opening paragraph:

We can do better than this. Better than runaway climate change and pandemics. Better than a spate of unconstitutional transfers of power amid a rising, globalizing tide of populism. Better than cascading human rights violations and unconscionable massacres of people in their homes and civic venues, in hospitals, schools and shelters.

Globally, the Human Development Index (HDI) took a hit during the Covod-19 pandemic. It has recovered, but is still below the pre-pandemic trend line.

The recovery has been uneven: while all OECD countries have recovered from the Covid-19 setback, only half of the “least developed” countries have done so. That means inter-country inequality, which had been closing for 20 years, is now widening.

The report notes disturbing political developments:

Troublingly, populism has exploded, blowing past last century’s peaks, which roughly corresponded to periods of mismanaged globalization. That is happening alongside, and in many cases exploiting, wicked forms of polarization, such as the winnowing and hardening of narrow identities, a sort of coercion or unfreedom enabled, if not outright celebrated, by an ongoing fetishization of so-called rational self-interest.

In this regard, while most people think positively about democracy, over this century so far there has been a rise, from about 35 percent to 52 percent, in the proportion of the population who think positively about leaders who may undermine democracy. The model is “a strong leader who does not have to bother with parliament and elections”.

Where Australia stands – we’re slipping

Among the 193 countries surveyed, Australia comes in at #10, behind the Nordic countries (as always), Hong Kong, Germany, Ireland and Singapore. In comparison with these other 9 countries we do well on expected years of schooling (#1) and life expectancy at birth (#4), but we have the lowest disposable income per capita (#10). In terms of income distribution, as indicated by the Gini coefficient, Australia is the third most unequal among these 10 countries: only Hong Kong and Singapore are more unequal.

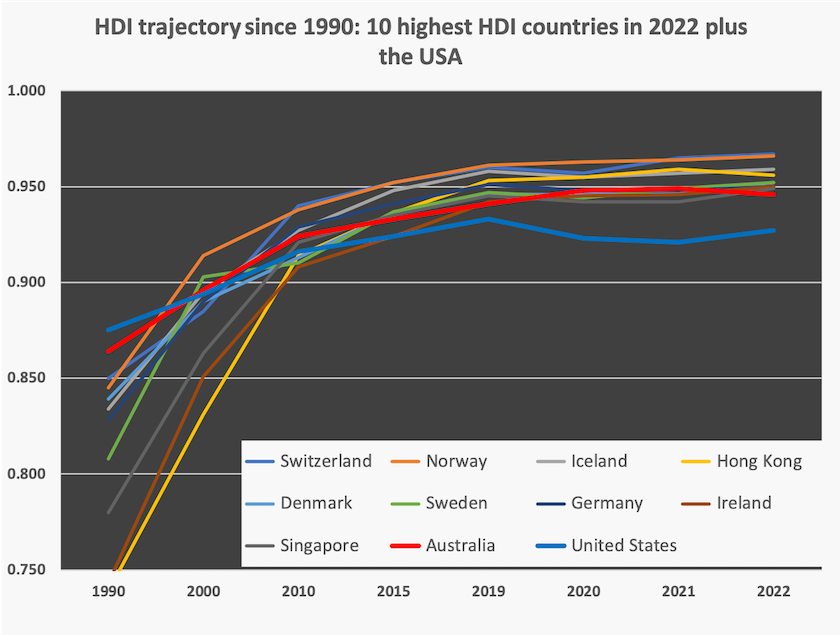

It is informative to look at how, among these 10 countries, Australia has travelled since 1990 when the series started. The trajectories of these countries is plotted below, and I have added in the USA, which now comes in at #20.

The general pattern of these ten countries has been one of convergence on HDI scores. In 1990 Australia (thick red line) was ahead of all the other 9 countries, but all have overtaken us. In fact our absolute score slipped a little between 2021 and 2022.

I added the USA (thick blue line) to illustrate the even stronger relative slippage of that country. In 1990 it occupied #1 position of all countries surveyed; by 2022 it had slipped to #20. It still comes near the top on income, behind small tax havens such as Ireland, but on other indicators, particularly life expectancy, its scores are poor.

Productivity – we’re starting to work smarter, not harder

The headline news in the Productivity Commission’s Quarterly Productivity Bulletin for March is that labour productivity increased by 0.5 percent in the December quarter. That should subdue demands by so-called employers’ organizations that real wages should be cut (not that they frame it that way), and support the government’s argument that low-paid workers’ wages should at least keep pace with inflation.

After having risen steadily for some years, labour productivity flatlined in around 2015, shortly after the election of the Coalition government. It surged during the pandemic, but this an artefact driven by the nature of productivity measures. As the Commission explains: “Labour productivity rose sharply at the start of the pandemic as workers temporarily shifted away from relatively low productivity sectors towards high productivity sectors due to lockdown restrictions, before declining as lockdown restrictions eased”.

The most promising sign in these figures is that in this latest quarter Australians produced more despite working less, because there was a fall in hours worked. In an economy with nearly full employment that suggests we’re working smarter, not harder.

The price of a flat white

What can be more insensitive than a grizzle about the price of coffee at a time when people are starving in Gaza and when many Australians would consider a coffee at a café to be an unaffordable luxury?

In a Conversation contribution Emma Felton of the University of South Australia looks at the price of a cup of coffee from a different perspective – it’s too low: Think $5.50 is too much for a flat white? Actually it’s too cheap, and our world-famous cafes are paying the price.

A model of the Australian economy

She demonstrates that in comparison with other countries the price of a flat white in Australia is ridiculously low. Cafés in Australia have been holding the price of a flat white at between $4 and $5 for some years, while their input costs have risen.

She breaks down those costs – about one third wages, one third overheads including rent, and of course there is the coffee itself.

Her article reminds us of three issues related to businesses such as cafes.

First is the burden of rents. Our shopping centres operate on a feudal basis, where the relationship between businesses and the shopping centre owners is akin to that of peasant farmers to the lords who owned the land. Even Marx had kind words for capitalism in comparison with feudalism, but we are yet to develop a functioning capitalist economy.

Second is the way governments try to compensate for costs faced by small business. Instead of dealing with uncompetitive markets in everything from rent to coffee beans, governments subsidize small business with tax breaks to compensate for the high prices they pay for their inputs, essentially requiring other taxpayers to subsidize the profits and extravagance of big businesses.

Third, and most important, is the distributive justice that could be achieved if we did pay a reasonable price for coffee – enough to pay staff a decent wage, enough to pay farmers in South America and West Africa. If the price of a flat white rose by 50 or 100 percent that would show up in the CPI, but it would be wrong to consider it as “inflation”.[1] It’s simply a case of bringing some prices up to a fair level that properly covers the production costs.

(Emma Felton must have stimulated academics’ interest in the economics of coffee. Garrit C Van Dyk of the University of Newcastle has another Conversation contribution: Who invented the flat white? Italian sugar farmers from regional Queensland likely played a big role.)

1. The key point is that price adjustments that compensate for distortions in prices, such as fair pay for workers in cafés or carbon prices, are distinguishable from price rises that feed back on themselves in “accelerating” inflation. ↩

Ten commandments for economic policymakers

Andrew Leigh gained his PhD at Harvard’s Kennedy School, the West Point of public policy. He has been able to condense the essence of good economic policy, as taught in such institutions, into ten points, in a speech he delivered to the Economic Society of Australia annual dinner at the Commonwealth Club (Canberra’s equivalent of the Melbourne club without misogynistic membership restrictions).

His ten lessons for economic policymakers:

- Focus on wellbeing, not just dollars.

- Think comparative advantage.

- Ignore sunk costs.

- Be bold.

- Use rigorous evidence.

- Consider expected value.

- Think in magnitudes, not just in signs.

- Channel a libertarian.

- Remember equity.

- Choose openness.

Those headings are cryptic: it’s worthwhile reading the short text of his speech, illustrated with examples.

All of these are sound advice, in line with the best teaching. But how many public servants, and members of non-government organizations, focus on just two or three of those, while neglecting the other seven or eight? Changes in the public service over the years, instituted by Labor and Coalition governments, have resulted in government employees seeing themselves more as employees of particular agencies, rather than as “public servants”. The result can be a lack of policy coordination, as each agency pushes its own aspect of the public interest.

Henry George and the ACT offer state governments $27 billion a year

One principle of taxation policy is that it’s a good idea to tax stuff that doesn’t move. Multinational firms and very wealthy individuals are mobile, and can tell the ATO they really live in Luxembourg or the Cayman Islands. Another principle is that it’s better for allocative efficiency to tax unearned or windfall income than income earned through effort, entrepreneurship and risk-taking.

So compelling are those arguments that in the late nineteenth century Henry George, a political economist whose views influenced public policy in the US Progressive Era, suggested that there should be a single tax, and that it be levied on land.

His ideas waned, but have been kept alive, and have been re-invigorated by extreme land price inflation and by calls from economists, most notably Thomas Piketty, that governments should shift taxes from income to wealth.

It’s not as if we don’t tax land at all. Local governments collect rates, but these are more akin to user charges (local roads and cycle tracks, trash collection, street lighting, sidewalks, kerbs, drains, parks, playgrounds, libraries) than taxes: the difference between taxes and user charges is not as clear as textbooks make out. And we have some rather dumb taxes on land, particularly stamp duty, which raises the hurdle for home buyers and discourages mobility. Nick Garvin of Monash University has a Conversation contribution Stamp duty is holding us back from moving homes – we’ve worked out how much. (He puts some figures around an inverse relationship between the rate of stamp duty and mobility.)

Our houses sit on land with an ever-growing market value, but we pay no tax on that accumulating wealth. If it’s an investment property we may have to pay a little land tax, but the real bonanza comes when our investment property is re-zoned. (Lech Blaine’s Quarterly Essay, reviewed in the 23 March roundup, describes how changed land use worked so generously to Peter Dutton’s advantage.)

The ABC’s Gareth Hutchens has been also writing about tax reform, specifically on the way we tax land, and unsurprisingly he mentions Henry George in his articles, adding another basic principle of tax design:

If you want less of something you tax it more, and if you want more of something you tax it less.

So why do we tax workers and businesses so heavily in this country, and why do we tax speculation and pollution and monopoly rents so lightly?

That quote is from his article If we taxed land properly, we'd have billions of extra dollars to fund big tax cuts elsewhere. So why don't we do it?. It’s in the broad context of tax reform, and as the title suggests it is about the possibility of using land tax to fund tax cuts in areas where they cause resource misallocation or discourage productive activity.

To illustrate the practicality of shifting taxes to land, he draws on a short research paper by Prosper Australia, a not-for-profit organization that has been advocating the adoption of Henry George’s principles for 130 years:Buying better income taxes with better land taxes.

In Canberra the government captures most of the rising land value

That paper draws on the land tax system in the ACT, which is well ahead of other jurisdictions in taxing land. At an average 1.0 percent of land value, ACT has the highest regular taxes on land, and it also has a betterment tax which captures 75 percent of windfall gains when landholders receive permission to redevelop land for a more lucrative purpose. This arrangement is helped along by the ACT having no separate local government, and the fact that the government owns all the land anyway.

While ACT residents receive what are called “Rates Notices”, they contain a statement “The ACT Government provides both state and council government services, which means your rates contribute to supporting our schools, hospitals and police in addition to local government services.”

Hutchens summarizes Prosper Australia’s research, which shows that if other states and the Northern Territory adopted the ACT system for taxing land, they could collect another $27 billion a year in revenue.

They play it with real money — yours

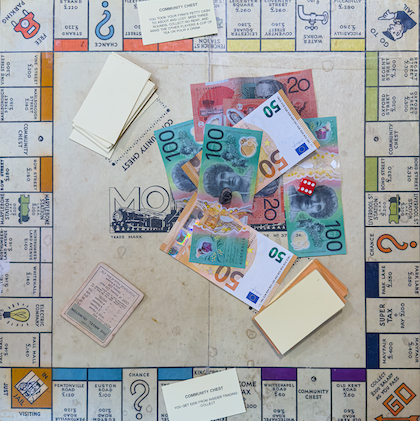

Hutchens has another article What do land tax, Monopoly, and Australia have in common? which is mainly about Henry George and his ideas, including an account of his speaking tour in Australia in 1890, where he gave “48 lectures, nine sermons, and numerous interviews, in 38 different cities and towns”.

He also uses the board game Monopoly – originally developed in the USA in 1904 as The Landlord’s Game by feminist and writer Elizabeth Magie – to illustrate the principles of Georgism “to show how rents can impoverish tenants and enrich property owners”.

Anyone who has played the game soon realizes that it’s a lousy game, but that’s the point Elizabeth Magie was making in developing the game. Once a player has a basic portfolio of properties, he or she goes on to clean the board. It’s being played all around us for real returns.

The slow road to lower vehicle emissions

The government has compromised on vehicle efficiency standards. Its explanation, for public consumption, is on the New Vehicle Efficiency Standard website, with links to FAQs and more details.

John Quiggin, writing in The Conversation, explains the political culture around the government’s decision: Australia must wean itself from monster utes – and the federal government’s weakening of vehicle emissions rules won’t help one bit.

The compromise isn’t about minimizing a burden on tradies, farmers, or campers. For the best part of 100 years tradespeople and farmers have been doing very well with ordinary utes based on passenger car modifications. And when they wanted something a bit more rugged they have had the Toyota Land Cruiser since 1960.

The sheep rode in the back (1938 Chev)

As Quiggin explains, most of the monsters now dominating the market, in spite of their size, have less carrying capacity than traditional utes, mainly because of the space taken by the twin cab. Because of their high clearance and large panels their trays are hard to access, and their glossy panels wouldn’t stand up to the rough handling on construction sites. And what farmer wants a twin cab? In times past the sheep rode in the tray, not in the neatly upholstered back seat.

These aren’t work vehicles. They’re passenger cars, and should be classified as such, but the main part of the government’s compromise has been a recategorization of these vehicles as light commercial vehicles (LCVs) meaning they enjoy a concessional path to emission standards, which are more lax than the standards applying to cars.

Specifics of the government’s standards are in the New Vehicle Efficiency Bill, which is horrible to read. The magazine Drive has an explanatory article: How Australian new-vehicle emissions rules have been relaxed to help utes, 4WDs, which includes examples of how certain vehicle types will be classified. It presents a table showing the standards to apply to cars and to LCVs – comparing the tighter standards in the original proposal with the easier standard adopted. For example by 2029 the car standard for CO2 emissions will be 58g/km, compared with 110g/km for LCVs. The LCV limit would have been 81g/km under the tougher option the government did not adopt.

The ABC’s Tom Lowrey explains the way different industry players have lobbied the government: Can Australia shift to EVs without kicking the big ute habit?. The outcome seems to be particularly favourable for importers of the US-style monstrosities such as Toyota and Ford. The Volvo-owned Polestar company is not so enthusiastic: they point out that tax concessions giving LCVs a break are pushing people into bigger cars they might not otherwise buy.

It’s extraordinary that this issue has commanded so much political attention. It should have been something easy to wave through Parliament after consultation with importers and consumer groups, while prioritizing efficiency standards. A policy that increases consumer choice, lowers the cost of operating vehicles, and which lowers pollution, should count as a no-brainer. It’s as if, when it comes to transport policy, the government is more concerned about the competing interests of the big players – airport owners, airlines, car importers, toll road companies – rather than the public interest. Ministers should be responsible to the voting public, not to the corporations in the ambit of their portfolios.