Other economics

Inequality – a threat to capitalism

It has taken a court challenge for a corporate board – in this case the Tesla board – to realize that waving through a $US56 billion pay for Elon Musk may be a little over the top.

It’s a hard figure to contemplate. It’s the GDP of Slovenia, an EU country with a population of two million. It’s 74 million years pay of a Bangladesh garment worker.

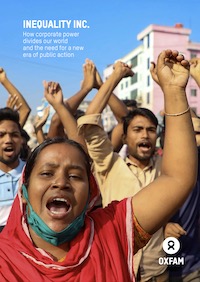

Oxfam’s report Inequality inc: how corporate power divides our world and the need for a new era of public action, prepared for the World Economic Forum meeting at Davos where the world’s rich congregate, presents hard and confronting data on global income and wealth inequality. They point out, for example, that since 2020 the five richest men in the world have seen their fortunes more than double, while almost five billion people have seen their wealth fall.

Lest we think that this is simply about what’s happening in other countries where the mega-rich live, Oxfam Australia reminds us that over the same period “the wealth of the three richest Australians, Gina Rinehart, Andrew Forrest and Harry Triguboff, has more than doubled since 2020 at a staggering rate of $1.5 million per hour”.

Maybe the right can dismiss OXFAM as the voice of bleeding hearts, but it’s harder to ignore the fact that OXFAM’s work is a confirmation of the World Economic Forum’s own work, published in its World Inequality Report.

The “small government” movement would do well to read the WEF’s chapter “rich countries, poor governments”. It shows that as private wealth has risen, public wealth – the common wealth – has fallen back. JK Galbraith’s observation of “private wealth, public squalor” is echoed by the Davos mob.

The WEF report does not shy away from the need for redistribution:

We stress on the outset that addressing the challenges of the 21st century seems hardly feasible without large redistribution of income and wealth inequalities. As a matter of fact, the rise of modern Welfare States in the 20th century countries which was associated with enormous progress in health, education and opportunities for all, was associated with steep progressive taxation to ensure that everybody contributed to the public good according to their own capabilities.

It concludes with a call to tax wealth – the wealth of individuals and the wealth of multinational corporations.

The conventional wisdom is that among those with economic power there is no political will for collecting more taxes to redistribute wealth and income and to fund public services. But that conventional wisdom does not explain why more than 250 millionaires and billionaires, gathered at Davos, have called for higher taxation on the super-rich, including themselves. Their letter to global political and economic leaders – Proud to Pay More– has a strong moral tone, and it also has a strong message in utilitarian economics: those who have done so well from capitalism do not want to see it wrecked by unsustainable inequality. To quote from the letter:

It is a demand for a return to normality based on a sober assessment of current economic conditions. We are the people who invest in startups, shape stock markets, grow businesses, and foster sustainable economic growth. We are also the people who benefit most from the status quo. But inequality has reached a tipping point, and its cost to our economic, societal, and ecological stability risk is severe - and growing every day.

Writing in The Conversation John Quiggin describes the countervailing currents among the world’s super-rich. Some see no end to their opportunities to go on taking more and more of the world’s share of wealth, while others heed the message from OXFAM that inequality is threatening the viability of our economic systems: As the billionaires gather at Davos, it’s worth examining what’s become of their dreams.

It is easy to think that OXFAM and the WEF are writing only about billionaires – the people who think about millions of dollars in the same way as we lesser mortals think about thousands of dollars, but their documents are about inequality more generally.

In his Policy Post – The huge cost of inequality – Martyn Goddard brings the issue home to Australia. He uses the hard figures on income and wealth inequality to bust myths about Australia as an economically egalitarian society. In his discussion of wealth inequality, which is growing much faster than income inequality, he looks at all aspects of wealth. That is not just the financial aspects, and not just the tangible material aspects such as housing, but also education, health and life chances.

Whether it’s from billionaires in Davos or independent researchers in Hobart, the message is the same: extreme inequality is economically corrosive. Market capitalism, the system that has brought prosperity to most of the world, relies on a distribution of power to prevent monopolization, a distribution of income to sustain demand, the collection of taxes to sustain the common wealth of physical and institutional infrastructure upon which the private sector relies, strong government to protect the natural resources upon which all economic activity depends, and a shared understanding that the returns to hard work and creativity will be fairly shared.

Interest rates: don’t expect the RBA to signal its intentions

Much of the stress endured by heavily-indebted mortgagees stems from the Reserve Bank’s 2021 assurances that interest rates would remain at their historic low rates until at least 2024. Anyone who was seeking some future commitment from the Reserve Bank Board in its statement on monetary policy on Tuesday, when it decided to leave rates on hold, should realize that the Bank has learned to be circumspect in anything it says about the future.

Tuesday’s statement looks very much like a cut-and-paste of earlier statements, with its differentiation between goods inflation (easing) and service inflation (still too high because of domestic cost pressures).

It states that “inflation remains high at 4.1 per cent”: this is a consistent misrepresentation in the Bank’s statements. No one knows what inflation is in February 2024. The 4.1 percent relates to the year from the December quarter 2022 to the December quarter 2023, which is influenced by price rises that were occurring up to 14 months ago. The latest reasonably robust indicator we have is that the CPI rose by 0.6 percent in the December quarter. That’s 2.4 percent annualized, almost in the middle of the RBA’s two to three percent range. It also means that with the cash rate at 4.35 percent, the real interest rate is probably back in positive territory, at about one percent.

The message the Board conveys with its numbers is important: their choice of the higher number – 4.1 percent rather than 2.4 percent – could influence inflationary expectations. Research by RBA staff members, Madeleine McCowage and Peter Rickard, Inflation expectations and the Australian economy, reveals that although few people are engaged with economic news, the informed and the uninformed tend to converge on the same level of inflation expectation, which in turn is influenced by the Bank’s announcements.

It’s unfortunate that the Bank’s statement on services does not provide a little more detail. A significant contributor to CPI inflation last year was insurance, which rose by 16 percent over the year. This has many causes, but domestic wage pressure is surely not one of them.

Why do we single out supermarkets when so many others are raising prices?

Why are we so angry at supermarkets?

Such has been the extent of community anger, accompanied by accusations of price gouging, that the government has directed the Australian Competition and Consumer Commission to inquire into the supermarket sector. It will be a broad-ranging inquiry, looking at pricing practices, supply chain issues and the industry’s competitive structure.

The ACTU has conducted a separate but related inquiry into price gouging, led by Alan Fels. Concerns with supermarket pricing may have led the ACTU into initiating the inquiry, and while the report covers food and groceries extensively, it is also about competition and consumer policy generally.

The ACCC’s concerns are too narrow. They are mainly about price collusion and indicators of market concentration, but there are many other business practices that lead to consumer detriment: the Fels report lists eight such practices, all of which are legal under present law as it is applied.

The report cites strong evidence that high corporate profits in Australia, particularly in sectors with limited competition, have not only been associated with inflation but have also been a factor contributing to inflation:

Claims that the rise in profit share in Australia as explained by mining do not hold up. The profits share excluding mining has risen and energy and other prices associated with mining have been a very significant contributor to Australian inflation.

The report mentions sectors other than supermarkets where suppliers have used their market power to sustain high prices. They include the finance sector (banking and insurance), airlines and electricity. The electricity market is characterized by loyalty taxes, unfair price discrimination, and deliberate confusion of consumers. Explaining the report on the ABC, Joseph Mitchell of the ACTU explains that at times electricity companies game the bidding system by withholding supply in order to drive up prices. That’s textbook monopolistic behaviour but it can occur in this byzantine construction known as the National Electricity Market. Consumers are upset by high electricity prices, but with Coalition politicians and fossil fuel lobbyists deceitfully attributing high prices to renewable energy policies, they are less likely to blame the industry in the same way as they blame supermarkets.

When the food market is dominated by two large supermarkets it’s hardly surprising that there will probably be some oligopolistic behaviour upsetting consumers. Coles and Woolworths between them made $3.8 billion profit before tax last year.[1] That looks like a big figure, but it’s only about $400 per household. Even if the supermarkets could run as a zero-profit utility, households would have only an extra $8 a week in disposable income.

Also, as incomes have risen over the long term, we have been spending a lower proportion of our income on food: in 1984 food accounted for just on 20 per cent of our spending. By 2016 that proportion had fallen to 17 percent. Even in households in the lowest income decile only 18 percent of their spending was on food.[2] Since 2016 food prices have risen by 26 percent, but so too have prices generally.

So why the anger?

We get some idea in a 30-minute segment of the ABC’s program The Money – Supermarket prices – where Richard Aedy interviews four people with deep knowledge of the industry. Surveys confirm that consumers have lost trust in supermarkets – Coles and Woolworths were once our most trusted brands. But there is little evidence of excess profits or high margins.

Cheap at this end of the supply chain

The same session deals with the relationship between suppliers and supermarkets, a relationship characterized by a great asymmetry in negotiating power. Even if supermarkets are not unfairly exploiting growers, the power imbalance can leave suppliers feeling exploited. As described by these experts, it appears that the supermarkets use their power to shift a great deal of supply risk and market risk on to farmers. These issues will be dealt with in the government-initiated review of the Grocery Code of Conduct (a voluntary code) to be headed by Craig Emerson.

Maybe some of our negative feeling is that we don’t warm to big powerful companies, and carry a (dated) image of struggling farmers. We certainly become annoyed when we see the saleyard prices of cattle and sheep fall, while the supermarket price of beef and lamb stays high. As Ross Gittins writes about supermarkets, prices are sticky – they go up like a rocket and fall like a feather. Firms rarely reduce posted prices: that’s one reason a small level of inflation is useful in an economy, because it can force real prices to fall.

As for consumers, they keep coming back to the big two supermarkets: it looks like a marriage where love has died, but which holds together because there’s too much hassle for either party to walk out.

In the Saturday Paperthere is a (paywalled) article by Rick Morton – Coles and Woolworths to face full ACCC inquiry – dealing mainly with the competitive structure of the industry. In comparison with other countries, our supermarket industry is more concentrated, and there is evidence that margins are higher. If you can’t get in behind the paywall, Rick Morton covers the main issues in Schwartz Media’s 7am podcast: Why time’s up for Coles and Woolies.

Aber hier nicht wilkommen

Besides examining existing structures, it may be worthwhile for policymakers to re-examine reasons the German low-price supermarket giant Kaufland in 2020 suddenly abandoned its advanced plans to open 20 stores in Australia as a move into the market. At the time there were serious allegations that established interests were colluding to block its entry.

There could be a risk that with so much focus on the Commonwealth and its powers, policymakers forget that the big supermarkets look for and exploit opportunities when local governments becoming involved in the development or redevelopment of shopping centres.

So there is no one reason why we have supermarkets in our sights. One possible reason is that price rises have been particularly high in staple products: the prices of bread, milk and oils have risen much more steeply than they have for other food products.[3] But this effect seems to be too minor to have set off the political reaction. Maybe it’s because we visit supermarkets so often: we don’t do weekly shopping for insurance or electricity and we don’t catch an airplane every week. Maybe we are reacting to the way supermarkets have upgraded their security systems, designed around the assumption that everyone who walks through the door is a shoplifter: mistrust begets mistrust. Maybe we dislike their slick pricing practices: as Fels points out, even unprofitable companies can treat consumers badly. And maybe we just don’t like big powerful companies.

1. In 2022-23 Woolworths’ income before tax was $2 322 million and Coles’ was $1 465 million. ↩

2. ABS Household Expenditure Survey 2015-16. ↩

3. All data from CPI Tables 1 and 5, ABS CPI. ↩

What’s the difference between a house and a share portfolio?

If you know the difference, read something else, or go and listen to some good music. But if you wonder how the two may be confused, read on, because over the last few decades, in much of the public mind, housing has come to be seen as a financial asset, rather than as something that serves basic human needs – shelter, and a place from which people make social connections.

A stark reminder about the commodification of housing is in the headline Millions of home owners made $3,000 in January but they probably didn’t notice on a post by the ABC’s David Taylor, where he has written about house prices and housing loans. There is nothing wrong with Taylor’s analysis, or with the data from the ABS and CoreLogic on which it is based: it’s all professional objective journalism. It’s the headline, almost certainly chosen by a sub-editor, that’s absurd. Unless your house underwent a $3 000 renovation in January, or you had the good fortune of its locational amenity improving with a new park or road, your house probably lost a little real value – “value in use” as economists say – as age and wear took their toll. The rest is inflation – asset price inflation that is not recorded in the CPI.

Writing in The Conversation Peter Martin describes how government policy could actually increase the nation’s real housing wealth: How Albanese could tweak negative gearing to save money and build more new homes.

We should have bought BHP shares instead

He points out that the combined effect of allowing people to claim interest as a tax deduction on so-called “investment” properties and a capital gains tax system that prioritizes speculators over patient investors, has resulted in it being easier for speculators to buy their third or fourth property than for young people to buy their first home. And because speculators almost always buy existing properties there is no increase in the stock of housing: all that happens is a contribution to demand-side pressure on housing prices.

Martin’s pragmatic suggestion is that negative gearing should be allowed, but only for investment in new housing. In that way there would be a real increase in the stock of housing and a saving to public revenue. It’s the proposal Labor took to the 2016 and 2019 elections, but which they abandoned because of a scare campaign and because it was part of a package that included dopey and inequitable changes to taxation of dividends.

Unsurprisingly, following the government’s breaking of its promise on Morrison’s tax cuts, the Coalition is now running a scare campaign on negative gearing. As Treasury has shown without comment, because interest rates have risen so strongly over the last 18 months the fiscal cost of allowing interest deductions has likewise risen. The case for disallowing interest as a deduction is at least as strong as the case for modifying the income tax cuts: economic conditions have changed.

But have attitudes changed? Martin’s argument is strong and valid: many economists have made the same points. But perhaps economically sensible reforms will have an easier political path if we can take the public understanding of housing back to what it was before it became commodified as an investment asset. We will have achieved that when sub-editors stop confusing housing inflation with wealth.

What’s sitting under our beds?

Published in the Reserve Bank Bulletin is an article by Patrick Elkington and Rochelle Guttmann Understanding the Post-pandemic Demand for Australia's Banknotes. Between 2020 and 2022 the value of banknotes in circulation increased by 22 percent or $19 billion, even while most transactions are becoming cashless. They estimate that we now have around $100 billion in banknotes in circulation. That’s around about $10 000 per household, and it’s mainly in $50 and $100 notes, rather than in small denominations that are used in day-to-day transactions.

I’ll get around to spending it one day

They estimate that about $14 billion are in transactional use, mainly in shop tills and banks, but that’s only a small part of the volume. They can attribute about another $40 billion perhaps to hoarding, but why would people hoard banknotes when interest rates are rising?

They suggest that there may be around $10 billion of banknotes in the shadow economy – concealed legitimate transactions to avoid taxation, and activities such as drug dealing. That still leave rather a lot, perhaps $30 billion, unaccounted for.

That residual should be of concern to policymakers. Maybe the methods used by the researchers, based on ABS methods, significantly underestimate the size of the shadow economy. Maybe it does not include cash payments made by businesses exploiting underpaid and undocumented immigrants.

Whatever the reason, there seems to be a compelling case for accelerating the move to a cashless economy. There would be a significant national saving in the transaction costs associated with cash (a cost most merchants underestimate), better tax compliance from small business, greater community safety as the returns from break-ins and pickpocketing are reduced, and a more difficult life for arms and drug dealers.

Those who have a vested interest in these activities trot out the condescending claim that a cashless society would be a burden on old people, who are assumed to be too stupid to use cashless transactions, but surely older people will be far safer if petty criminals learn that older people carry no cash.