Other economics

What the Reserve Bank didn’t do last Tuesday

The Reserve Bank’s statement accompanying its decision to keep interest rates on hold reads as if it was written by someone desperately looking for a hint of inflation and being unable to find it. The author seemed to be particularly disappointed that the ABS has not provided more data on services inflation in its monthly indicator series.

Peter Martin in his regular Conversation contribution finds hints in the RBA statement that it is becoming less hard-line: Will the RBA raise rates again? Unless prices surge over summer, it’s looking less likely. He notes that while there have been price rises in services, the price of goods is falling.

If the RBA’s main concern is with wages as a driver of inflation, it may not relent in its crusade. But if its concern is with the net inflation figure, as indicated by the CPI, where goods deflation offsets services inflation, it may relax. The whole nature of economic development, thanks to technology and trade, is for the price of services to rise relative to goods. That’s how real incomes rise over time.

The ABC’s Michael Janda covers the Bank’s decision in a short article Interest rates on hold until February as RBA pauses. It includes a telling observation, apparently by the AMP’s Shane Oliver, about the lagged effect of interest rate changes. Between 1988 and 1990 the RBA was aggressively raising rates while unemployment kept falling, but then unemployment suddenly took off and the RBA had to reverse course. To emphasize a point missed by so many commentators, monetary policy operates with a lag.

Reserved for Reserve

It could be good for Australia if the RBA Board rented a large houseboat over the January break, with each member taking a turn at steering, so that they could get a feeling for the behaviour of powerful controls with long lags.

The next monthly CPI indicator, covering November, will be released on Wednesday January 10, and the next CPI, covering the October-December quarter, will be on Wednesday January 31, before the next RBA Board meeting on Tuesday February 6.

GDP – a mixed bag

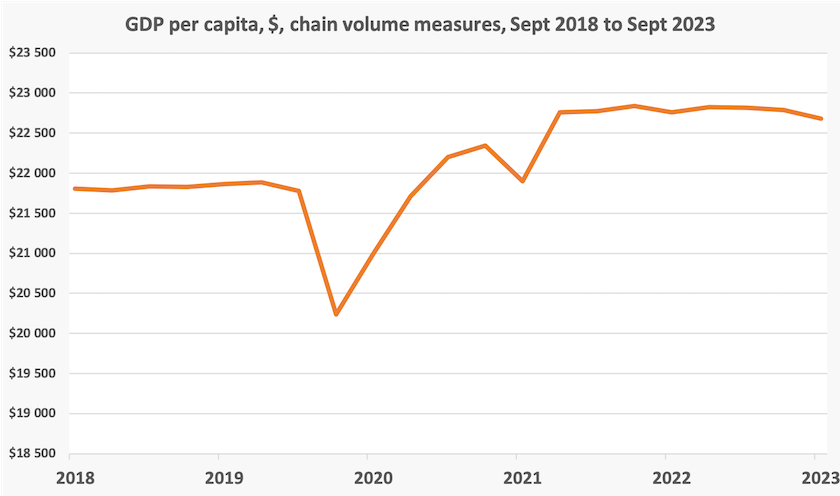

Economists were expecting a higher figure, but our GDP came in on Wednesday with a growth of just 0.2 percent over the quarter. Per-capita GDP went backwards by 0.4 percent. This is the second quarter in which GDP per-capita has fallen, leading some to say we’re in a per-capita recession. That is confirmed by figures on disposable income.

The situation is a little more complex than a simple slowdown in growth, however. The diagram below shows GDP per capita over the last five years, covering the period before, during and after the pandemic, including the last year of rapidly rising interest rates.

This pattern confirms the notion that during the pandemic the government over-stimulated the economy fiscally, and that for the last 18 months the RBA has been reining the economy back with monetary policy.

Public investment is one of the few areas of growth, suggesting that serendipitously it has provided a necessary Keynesian stimulus, rather than a contribution to inflation as Treasury and Transport Minister King regard public investment. The domestic demand deflator (a more all-embracing indicator of inflation than the CPI) rose by 1.3 percent over the quarter, implying an annual rise of 5.3 percent, but this is well down on the 1.9 percent in the same quarter last year.

The rate of household savings has dropped from about 25 percent at the peak of the pandemic (there wasn’t much to spend money on), to almost zero: it was running at about 5 percent before the pandemic. There is plenty of evidence in these figures to confirm that some households are doing it tough and that inflation is on the way down. Has the RBA overshot – once again?

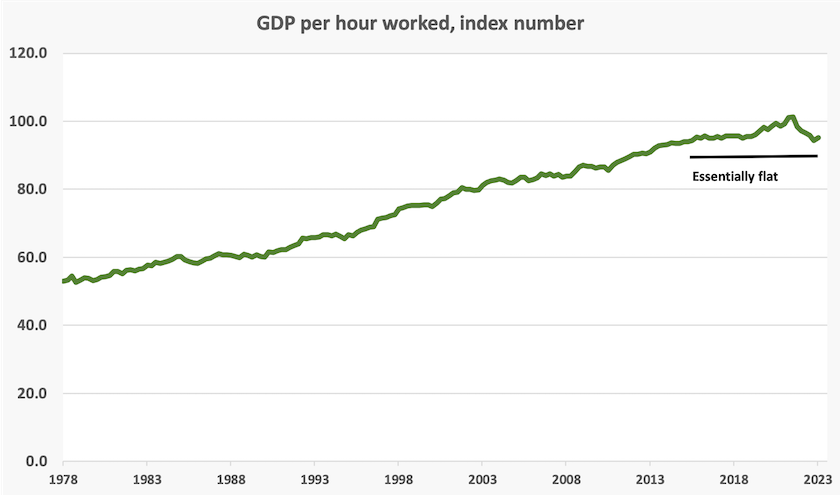

One unexpected figure is that in the latest quarter GDP per hour worked – a first-order indicator of labour productivity – has risen, after having fallen for the previous five quarters. But in the longer-term context that’s just a tiny uptick at the end of a graph of unimpressive productivity performance.

Our strongest productivity growth – indicated by the steepness of the line – was in the 1980s and 1990s, largely resulting from the Hawke-Keating structural reforms and strong commodity prices in the 1990s. But from about 2013 there has been hardly any productivity growth. There is an apparent uptick around the pandemic, but this is an artefact resulting from the way the pandemic and governments’ responses to it caused the figures to do some weird stuff. The curve is headed back to where it has been for the last ten years – that is, almost flat.

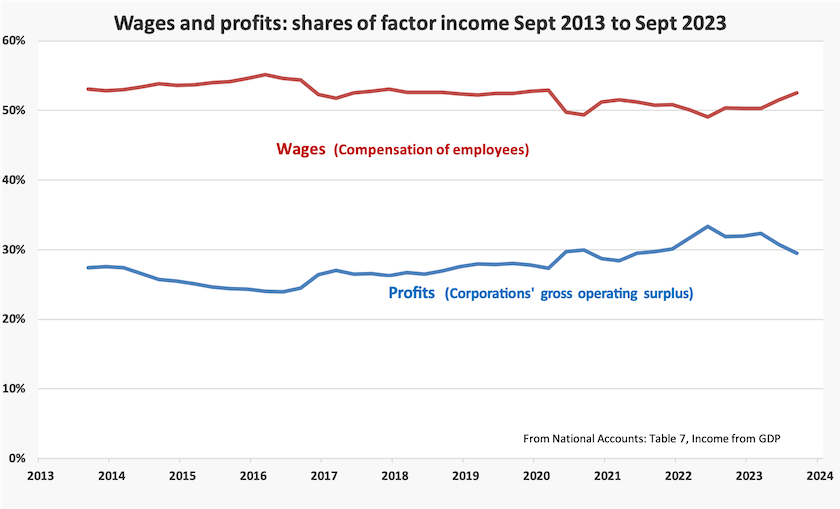

One less ambiguous figure is that the wage share of national income has continued its recovery towards levels seen earlier in this century (but still nowhere near the share wages enjoyed in the twentieth century).

“You’ve never had it so good”

That statement was attributed to the Conservative UK Prime minister Harold MacMillan in 1957. Reserve Bank Governor Michele Bullock came close to expressing such a sentiment last week when, in a speech to other central bankers, she said that households and businesses are actually in a pretty good financial position.

She might have provided more cover for herself had she said “most” households.

Paul Bongiorno, in his regular Saturday Paper contribution, explains how the so-called “cost- of-living crisis” is playing out politically. In response to apparent failing poll numbers, and Murdoch media stories of a government in chaos, Labor backbenchers and party members are pressing the government to do something about the cost of living. That is, something more significant than its so-far modest moves in areas such as prescription pharmaceuticals and the cost of child care: MPs push Albanese on cost-of-living crisis.

The government faces economic constraints in spending any money directly. Although the government is probably running a significant cash surplus, it fears that the trigger-happy Reserve Bank will see even the most minor fiscal expansion as an excuse to raise interest rates.

It is also constrained politically, because it does not want to be seen as being pushed by the opposition – an impression the media has already created in relation to the immigration detention issue. If it is to do anything to modify the Stage 3 tax cuts it would be best done in next year’s budget.

But how deep is this cost-of-living crisis?

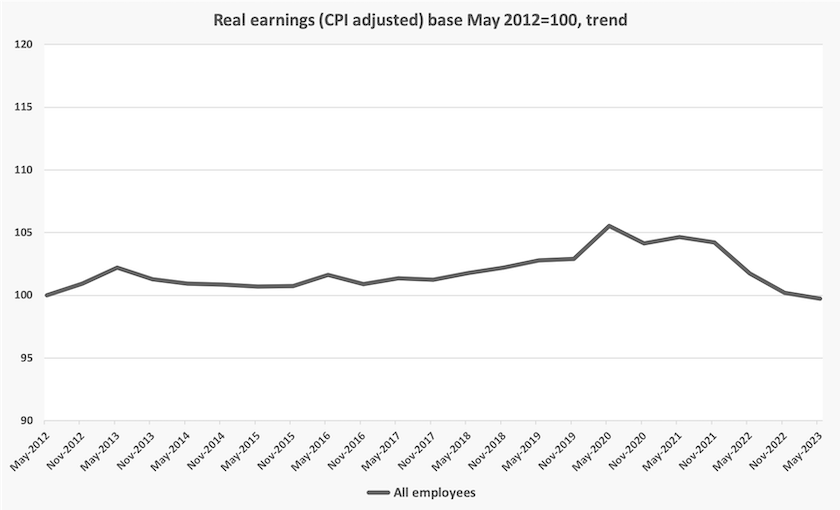

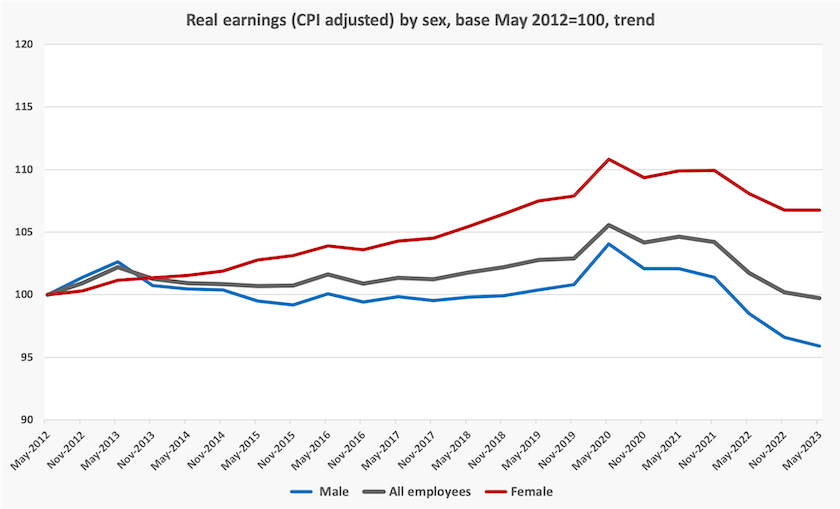

We can get some indication by looking at how real (CPI inflation-adjusted) earnings have been moving. Using the CPI as a deflator should cover most changes in the cost of living, but with the important exception of mortgage interest. We have ABS earnings data only up to May this year (the next release up to November is in February), based to May 2012 when the present series starts. This is shown in the graph below.

Real earnings hardly moved until they were boosted during the pandemic (when there wasn’t much they could be spent on), before falling back to their 2012 level, inflation having clobbered a small rise in nominal earnings. A Harold Macmillan may observe that no one was complaining in 2012 when incomes were at the same level and ask why they’re complaining now. But as psychologists demonstrate (in line with common sense), when we gain a benefit and subsequently lose it, we are subjectively worse off than if we had never had the benefit in the first place. Also in mid 2012, although interest rates were about the same level as they are now (RBA rate now 4.35 percent; May 2012, 3.75 percent) they were then on the way down.

A more complex picture is painted when we use the same data to see how earnings have moved for men and women, The graph below is the same as the graph above but with lines for men’s and women’s earnings..

In terms of the different earnings experiences of men and women something quite significant is happening – indeed has been happening for the last ten years. There are many plausible explanations: I’ll leave that to others with more knowledge of the labour market.

Employment services – another Coalition mess to clean up

A House of Representatives committee has produced a major report on employment services. It covers the failure of privatized employment services and calls for the re-establishment of a government financed and staffed service. It also raises the basic issue of the public service’s capacity to provide policy advice. In our democracy what roles should be played by Parliament and by the public service in providing policy advice?

A little history of employment services

One of Australia’s modest but effective nation-building services, established by the Chifley government in the postwar period, was the Commonwealth Employment Service, as recommended in the 1945 White Paper on Full Employment. It was a government-funded and government-staffed employment agency, with several hundred offices throughout the nation offering practical help in connecting job-seekers with potential employers. A true public service.

The Howard government abolished it in 1998, replacing it with the privatized Job Network, which, explains the ABC’s Gareth Hutchens:

… encouraged independent providers from the private and community sectors to compete to find jobs for the unemployed, helping the old government-run service to die a slow death. It also intensified the use of "mutual obligations", which force unemployed Australians to do often pointless activities in return for receiving unemployment assistance.

Hutchens’ article – The Howard government 'radically transformed' the job search experience. Will this government tear up the failed experiment? – explains that the program went through several iterations and re-naming, but at its core were competition among private providers, and so-called “mutual obligations” linked to payment of unemployment benefits.

Over the years it came in for increasing criticism from many quarters. Welfare organizations have focussed on the “mutual obligation” aspect, some requirements of which are not only unnecessarily burdensome on job-seekers, but are also so ineffective that they leave job-seekers feeling inadequate and demoralized after they have had N knockbacks from N applications, and when they find the training course they have had to attend provides no marketable skills.

The system has been characterized by high administrative costs, not only among the privatized agencies, but also by firms that place job-seekers referred by the system.

And it was a textbook case of how in some situations privatization and reliance on competition just doesn’t work. The private providers soon responded to incentives to work to the performance indicators, such as getting people placed in jobs even if they are short term, or providing training courses even if they were irrelevant to the needs of the economy or to those of the job seeker.

The House of Representatives Report

In August last year a House of Representatives Select committee was established to inquire and report on employment services. Its 600-page report Rebuilding employment services was delivered last week. There is also a more digestible parliamentary media release summarising the committee’s main findings and recommendations.

Its main finding was that privatization had failed. To quote from that release:

It’s harsh but true to say that Australia no longer has an effective coherent national employment services system; we have an inefficient outsourced fragmented social security compliance management system that sometimes gets someone a job against all odds.

and

The nature of competition is counterproductive. In regional towns or disadvantaged suburban centres it seems there is an employment services provider on every street block, heavily regulated and providing largely the same service with little variation or innovation. Five ice-cream shops all selling the same vanilla ice-cream lined up side-by-side, while the Department studiously manages market share so everyone gets a lick. It’s nonsense.

There have been calls to re-establish the Commonwealth Employment Service, and the recommendations go most of the way there: the re-built system, Employment Services Australia, should have a “public sector core” with an enduring presence in local communities. Where private agencies are involved the working arrangements envisaged seem to be more like co-production rather than the present model of contract management.

Mutual obligation is to stay, but involving a “tailored approach” and with less red tape.

Unsurprisingly there is a dissenting report, by Liberal MP Aaron Violi. His main disagreement is with the finding that there is excess competition among providers. Evidence cannot shake a blind faith in competition.

Russell Broadbent, who was the deputy chair of the committee and the only other Coalition member on the committee, did not join Violi in the dissent. By the time the committee reported he had left the Liberal Party and was sitting as an independent. (Details of the committee’s workings are available on its parliamentary website).

Media reports such as those on the ABC and the Age/Sydney Morning Herald are mainly a summary of the parliamentary media release. The Guardian’s cover of the report includes an observation that the Greens and some welfare organizations are seeking for “mutual obligation” to be dropped entirely. (Perhaps dropping its name would help.)

In a joint statement with the Brotherhood of St Laurence the Centre for Policy Development welcomes the report’s findings and urges the government to implement its recommendations.

The Conversation is usually a source of comment on major policy issues, but all it offers so far is what looks like a quick cut-and-paste by Michelle Grattan.

Public service capacity

Perhaps the absence of detailed analysis or considered criticism is due to the report’s length. It won’t make it on to anyone’s summer holiday reading list. But the ABC’s Gareth Hutchens obviously made his way to Page 509, where he found this paragraph about the challenge in re-building the Commonwealth Employment Service:

Numerous experts, academics, former senior public servants, and practitioners have cautioned the Committee that the biggest obstacle to system reform is likely to be entrenched resistance – even hostility – in parts of the Australian Public Service (APS) given a decades long belief in full marketisation, a lack of experience in service delivery and the sheer convenience of being able to blame contractors for systemic failures. As outlined in this report, successive governments and senior bureaucrats have remained detached from the messy reality of communities, regional labour markets, and service delivery. As with other privatisations, bureaucrats and politicians avoided direct accountability for systemic failures and public discontent by blaming contracted providers. The shift proposed in this report is significant, and challenging orthodoxy brings risk. However, change is essential as the current system simply does not and cannot work.

That's a damning comment on the damage the managerialist ideology has inflicted on the public service. One can lay the blame at Howard and the “small government” disciples in his administration, but even university schools of management enthusiastically embraced the simplistic curriculum of “New Public Management”. Because it involved no economics, or rigour in any discipline, it was easy to teach and to write papers for journals, and provided an easy pathway for academics to find work in consultancy firms.

On the same theme we may ask why this review of employment services has been done by a parliamentary committee and not by the public service. Staff serving parliament committees are well-qualified academically and hard-working, as the detail in this report attests. But they are generalists, and they lack the deep knowledge one should find in a well-functioning public service.

A review conducted by a professionalized public service would probably come to the same conclusion about the failure of the privatized employment services system. But it may have more policy depth about the economic role of employment services, and the nature of unemployment. The old CES system was very good at dealing with frictional unemployment (unemployment as people shift from job to job, enter, or re-enter the workforce). It was not set up to deal with structural unemployment (unemployment resulting mainly from skills mismatch): that wasn’t seen as necessary in the postwar period.

Its privatized replacement, driven by short-term performance metrics, failed miserably, not only because of perverse incentives, but also because the whole model was not suited to deal with structural unemployment.

Then then there is the question of “mutual obligation”. If one arm of government, the Reserve Bank, is seeking an unemployment rate no lower than X percent, and if in the normal business cycle the unemployment rate is often much higher than X, what is the point of the unemployed applying for jobs that don’t exist, as a matter of public policy?

Years of the “small government” ideology, the stupidity of managerialism, and the idea that those in public employment are incompetent and lazy in comparison with their private sector counterparts, have inflicted tremendous damage on our public service. Perhaps that’s why the government turned to a committee rather than to a government department to provide this review.

Do we want parliamentary committees to become our main or sole source of policy advice? We can look at the US as an example of a country with a weak and politicized public service, but with elected lawmakers who become intricately involved in policy details. Do we want to follow that model?

How about “reasonably fast rail”?

Germany, with a population of 82 million, has no city as large as Sydney or Melbourne, and only three cities larger than Adelaide. But here, with a population of one third of Germany’s, we have 17 million people crammed into 5 cities with a population of more than 1 million.

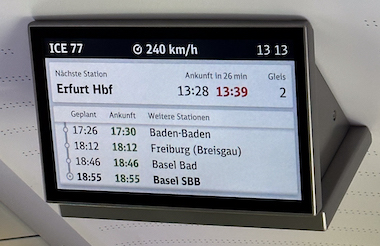

Much of the difference can be explained in terms of transport. Northern Europe has dense road and rail networks. Some large population and employment centres are connected by very fast trains at speeds up to 300 kph on sections of suitable track, but these are at the top of the rail hierarchy. For every ICE or TGV there are many more modest trains connecting villages, towns and cities.

Last weekend, on Saturday Extra Geraldine Doogue interviewed transport economist Peter Thornton: Even reasonably fast rail would be good. (16 minutes). The idea of a very fast train from Brisbane to Melbourne keeps getting kicked down the road, but Thornton argues strongly for what he calls “reasonably fast rail”, with speeds of around 150 kph, connecting our big cities with smaller population centres, such as Sydney to Newcastle, or Melbourne to Geelong. The case for such investment lies in easing pressure on our big cities and in so doing making housing in reach of employment centres more affordable.

Thornton’s presentation aligns neatly with Alan Kohler’s Quarterly Essay on housing, and to Malcolm and Lucy Turnbull’s ideas on housing and urban planning, linked in last week’s roundup.

It is refreshing to hear policy experts acknowledge the link between housing policy and other policies, even if state and Commonwealth bureaucracies are trapped into compartmentalized thinking.

Needs some straightening for a reasonably fast train

Unfortunately just a few weeks ago Transport Minister Catherine King, in the Commonwealth’s much-hyped infrastructure statement, put both the Sydney-Newcastle and Melbourne-Geelong projects on the back burner. The only project that seems to be going ahead is the Brisbane-Gold Coast link, to be built in time for the 2032 Olympics.

Transport economists and urban planners are unenthusiastic about Melbourne’s grand proposal for a suburban loop which does not serve any identified purpose. Fast lines to link Melbourne to Geelong, Ballarat, Bendigo and Shepparton would show up far better on benefit-cost grounds.

Thornton points out, correctly, that many rail projects are not financially viable. But that doesn’t mean they are not economically viable, if they pay a dividend in terms of lower housing prices and lower commute times, that do not come back to the original investors. (Economists refer to such benefits as positive externalities.)

We will probably go on under-investing in rail infrastructure so long as the political debate is centred on immediate affordability in rather than in terms of economic returns and the national balance sheet.