Other economics

A calm consideration of inflation and interest rates

On Tuesday, Melbourne Cup Day, the Reserve Bank will make its decision on interest rates. In making its decision the RBA will take into account the ABS CPI data for the September quarter.

It has been intriguing to read the media commentary on that latest CPI, which is mostly along the lines that because expectations were for a 1.1 percent rise, and the CPI came in at 1.2 percent, the odds on a Reserve Bank rise in interest rates shortened significantly. It’s as if the staff and board of the RBA could be replaced by a computer linked to the ABS with a one-line program: IF CPI > X, <Y, D INT = 0.25%.

John Hawkins of the University of Canberra, who has spent a little time looking at the ABS data and some other sources of data on price movements, has a Conversation piece: Petrol is holding up inflation – the 7 graphs that show what’s happening to prices and what it will mean for interest rates. Anyone looking at these graphs is drawn to the conclusion that inflation is on the way down and that there is little reason for the RBA to lift rates

Peter Martin has a similar Conversation contribution: Think the RBA will lift rates on Melbourne Cup day? Don’t bet your house on it. He too points to evidence that CPI inflation is easing.

He also draws attention to a speech by RBA Governor Michelle Bullock – Monetary policy in Australia: complementarities and trade-offs – in which she shows how different households’ discretionary income (using a household equivalent of the corporate measure of free cash flow) has changed over the last two years. Indebted owner-occupiers, the households that would be most adversely affected by a further interest rate rise, have already taken a significant hit to their discretionary income. For them monetary policy is working, all too effectively.

Martin’s main point is that while the RBA is clearly concerned with present inflation indicators, it is also concerned with inflation expectations. It has to smooth out the noise in ABS data (for example volatile gasoline prices) and to consider how decision-makers, from households through to trade unions and investment banks, believe inflation is trending. The CPI is a lagging indicator, but the RBA tries to assess what inflation is nowand what it is likely to be in the future. It’s about informed judgement: the RBA certainly cannot be replaced by a computer hard-wired to the ABS.

It is worrying that financial markets are so rapid in reacting to statistical data: do the BSDs on the trading desks spend more than a few nanoseconds looking at ABS statistics? As Keynes said “When the capital development of a country becomes a by-product of the activities of a casino, the job is likely to be ill-done.” It is likely to be even worse-done when the gamblers, like novices at Flemington, don’t take time to think about the odds.

Too much attention is placed on headline statistical indicators, and there is too little acknowledgement that “inflation” is a complex and not-easily-grasped concept, which isn’t captured in the CPI. We need those indicators, but perhaps, in the interests of financial stability, it would be useful if the ABS were to drop its monthly CPI indicator series, which is less thorough than its quarterly data and subject to higher levels of errors of estimate.

The IMF on Australia

The IMF has produced a short assessment of the Australian economy with the appealing title Australia: Staff Concluding Statement of the 2023 Article IV Mission. It’s pretty well what one would expect from the IMF – orthodox economics, with a bias towards austerity and a pathological fear of inflation.

It’s a deadpan assessment of public policy, and it urges the government to work on productivity, housing supply, climate change, education and other structural reforms.

Media has focused on one sentence: “Staff therefore recommend further monetary policy tightening to ensure that inflation comes back to the target range by 2025 and minimize the risk of de-anchoring inflation expectation”, suggesting that the IMF is putting in a bid for the RBA to raise interest rates on Tuesday, but the document is more nuanced than is implied in this one statement.

The OECD on Australia

The OECD has published its Economic Survey of Australia. It’s a fairly straightforward assessment of our fiscal and economic settings.

On one level it presents a picture of the Australian economy in line with the Albanese government’s priorities. It stresses that policies should work towards hastening our energy transition and moving to greater gender equality, for example. It’s typical of OECD statements that generally carry the impression that member nations’ public servants have had a hand in their drafting.

But it also goes into territory that the government may be cautious about entering. It stresses the need for tax reform, suggesting we need to increase the scope and rate of GST, and to reduce concessions on private pensions.

How should we interpret our impressive labour market figures?

Our labour market figures point to a strong labour market: the unemployment rate is 3.6 percent and our labour market participation rate is 67 percent.

It’s many decades since we had an unemployment rate below 4 percent, and there has been a long-term trend of higher labour force participation. In comparison with other countries these are impressive figures.

But a regular Productivity Commission series, its Quarterly productivity bulletin, paints a less glowing picture of the labour market. Putting the June quarter figures bluntly, the Commission states “Australians worked longer, but were less productive”.

It’s common for productivity to fall as unemployment falls: that’s because new workers tend to be less productive than established workers. But the Commission also suggests that poor economic performance may be forcing more people into the labour market: “As cost-of-living pressures bite further, workers may respond to this negative real wealth shock by seeking to work more hours to try to maintain a reasonable standard of living over time”.

The Commission’s prescription is in line with established economic theory: “greater attention should be directed toward increasing output through increased investment, efficiency and innovation”.

Why are Australians going hungry?

A land of plenty

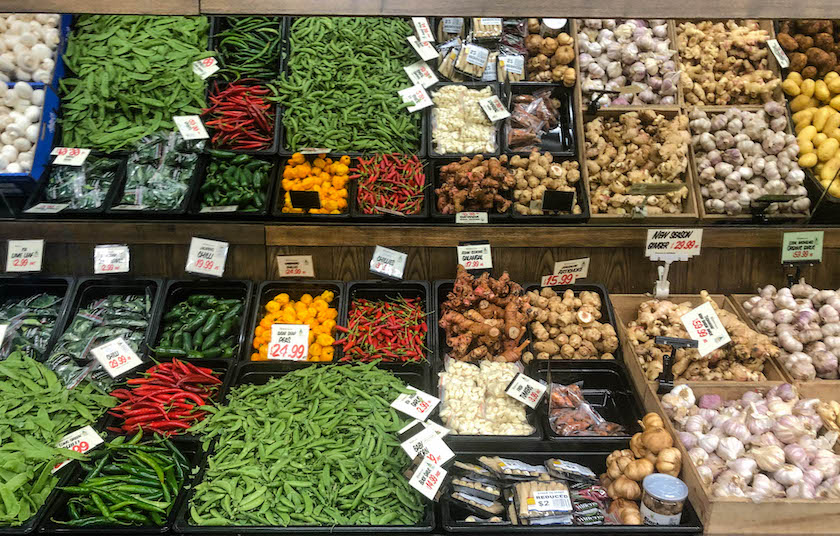

Last year 3.7 million Australian households (36 percent of households), experienced some level of food insecurity. For most of these it was short term – while waiting for payday or for social security perhaps. But of these 3.7 million, 0.7 million were in chronic food insecurity.

These figures are taken from the Food Bank Hunger Report 2023.

We live in a bountiful land. The Australia Farm Institute notes that Australia exports enough food to feed more than twice its population. Apart from outback regions where there has been a serious neglect of road investment, our distribution systems are adequate to get food to all who need it. In Australia, of all countries, there is no physical reason anyone should go hungry.

As happened in the 1930s Great Depression, the problem lies in our economic structure, a structure shaped by the neoliberal idea of “small government” – an ideology embraced by both Coalition and Labor governments, and the Coalition idea that economic growth can be promoted by suppressing wages and social security transfers, and trusting that the benefits would trickle-down. Both public ideas have imposed a huge opportunity cost in terms of economic benefits forgone, and a huge cost in misery, including food insecurity.

Although these developments are long-term, it is becoming increasingly common for journalists to confirm the Coalition spin that we have a “cost-of-living crisis”, resulting from poor policy decisions by the Albanese government. The political narrative, expressed by commentators such as Michelle Grattan, is that cost-of-living pressure could restrict the government’s broader policy objectives, and could spend down its political capital very quickly.

The trouble with this narrative is not so much that it could aid in the election of a Dutton government (as economically damaging as that prospect would be). More seriously it attributes our inability to achieve a morally acceptable distribution of income and opportunity to what a government can achieve in its first 18 months in office, when it has inherited an economic structure 25 years in its making.

Although Coalition governments were in office for 19 of these 25 years, if blame is to be allocated it should be to the public ideas that have infected the way politicians, lobbyists, journalists and others think about public policy. We all need to be thinking about our economic structure, rather than short-term policies.