Macroeconomics – inflation, interest and incomes

Wobbles in global banking, uncertainties about whether inflation is under control, and widening inequality in wealth and income, are contributing to a difficult pre-budget period.

The days of cheap money are behind us – but let’s not worry too much

For the last 15 years, ever since the Global Financial Crisis, money has been cheap. Households, businesses and governments have been able to borrow money at very low rates – negative real rates at some times.

That period has ended abruptly, according to Geraldine Doogue’s guests Pater Martin and Nicki Hutley, who were on last weekend’s Saturday Extra: Money gets expensive.

Although interest rates, real and nominal, seem to be doing nothing more dramatic than moving back to their longer-term levels, the pace at which they have risen has taken many by surprise. A handful of bank failures and revelations of weak balance sheets are leading to a much more cautious approach by banks. It’s not just a shift in rates, but it’s also a change in attitude, from cheap money to the more normal state of expensive money.

Pater Martin points out that during the period of cheap money businesses and governments failed to take up the opportunity to invest when rates were low – when, in real terms, money was free. Businesses (conditioned by a hundred years of high returns) applied high hurdle rates to new investments (generally returning profits to shareholders rather than re-investing), and governments similarly failed to borrow for necessary infrastructure. Households, however, did respond, and their borrowing for “investment properties” resulted in extreme house-price inflation.

Martin points out that had our governments taken advantage of cheap money, at negative real interest rates at times, we could by now have re-wired the nation and built a fast train linking our main capitals, while having a stronger public balance sheet. He doesn’t go into the politics of this negligence, however.

The Commonwealth failed to take up this opportunity because it was politically convenient for the Coalition to perpetuate the lie that there is something intrinsically bad about public borrowing, even when it is for investment. Furthermore the Coalition has contempt for public investment: nation-building projects such as fast trains and national electricity grids shouldn’t be allowed to crowd out worthy private sector projects such as new casinos and coal mines.

The Coalition conveniently ignored their demonization of public debt when there had to be a massive fiscal stimulus during the pandemic, accompanied by even lower interest rates. This combination of easy fiscal and monetary policy provided a big boost in demand, but because successive governments, mainly Coalition, have failed to address structural weaknesses in our economy, there has been an inadequate supply-side response. The consequence has been a bout of inflation.

Reluctance to borrow to invest carries over to the Labor government. Green and key independent senators have correctly identified the government’s much publicized Housing Australia Future Fund as a pitifully inadequate response to our shortage in public housing. Provided there is adequate capacity in the building industry, here is a chance for our governments to invest in solid assets, while having a real supply-side effect on the whole housing market.

Maybe the government’s reluctance to invest stems, in part, from conventions in government accounting, for apart from some Commonwealth-owned assets (e.g. Snowy 2.0), disbursements to the states for capital purposes show up on Commonwealth accounts as recurrent outlays. Cosmetically the Commonwealth balance sheet is weakened, while the states receive a windfall asset. If those Commonwealth and state balance sheets could be consolidated there would be no weakening of the government balance sheet. That accounting convention is one reason why we have such severe deficits in roads, railroads, urban public transport, and public housing. But the main reason is still the idea, nurtured by decades of spin from the Coalition and its media supporters, that there is something wrong about borrowing to invest.

If we could have a government willing to explain public finances, and more journalists who understood basic accounting, that impediment to public investment could be overcome.

Is another financial crisis looming?

On Late Night Live Satyajit Das comments on specific factors that brought down the Silicon Valley Bank and the UBS. He also warns that some parts of the less-regulated non-bank financial sector are not particularly secure. Are we on the verge of another global financial crisis? (17 minutes)

Das confirms the general belief that in comparison with banks in the USA and western Europe Australia’s financial sector is secure, well capitalized and adequately liquid. He advises Philip Adams that he needn’t take his money out of the NAB and put it under his mattress.

It is notable, however, that APRA Chair John Lonsdale has felt it necessary to state in a televised conferencethat “Australians can be confident their banking system is among the strongest and most resilient in the world”. His reasoning is credible, but why do we need a “don’t panic” message?

Bank runs and collapses precipitate panics and make headlines: that risk seems to be contained for now. A general shift to risk-aversion, rising interest rates, and regulated or self-imposed tightening of credit, can be just as damaging to the world economy however, and Australia would not be immune from its effects.

Satyajit Das’s most recent book is Fortune’s fool: Australia’s choices.

Latest CPI figures reveal that inflation is now only 2.1 percent: the RBA can take a break

On Wednesday the ABS released its monthly CPI Indicator for February, revealing that between January and February the CPI index moved from 117.7 to 117.9. Annualized this reveals inflation is now 2.1 percent – well within the RBA’s target range.[1]

Of course that calculation, while it is mathematically correct, has a wide error of estimate, because it is based on a small difference between two observations, each with their own error of estimate.

But the point is that what should be guiding the RBA for its decision next Tuesday is the rate of inflation now, or even better, what it will be in coming months, not what it has been in the past.

The media are reporting that the latest CPI indicator reveals that CPI inflation has fallen from a peak of 8.4 percent in December, to 7.4 per cent in Jamuary, to 6.8 percent in February. Those figures are all mathematically correct as indicators of inflation over 12 months, but they may say little about what inflation is now, or likely to be in the coming months.

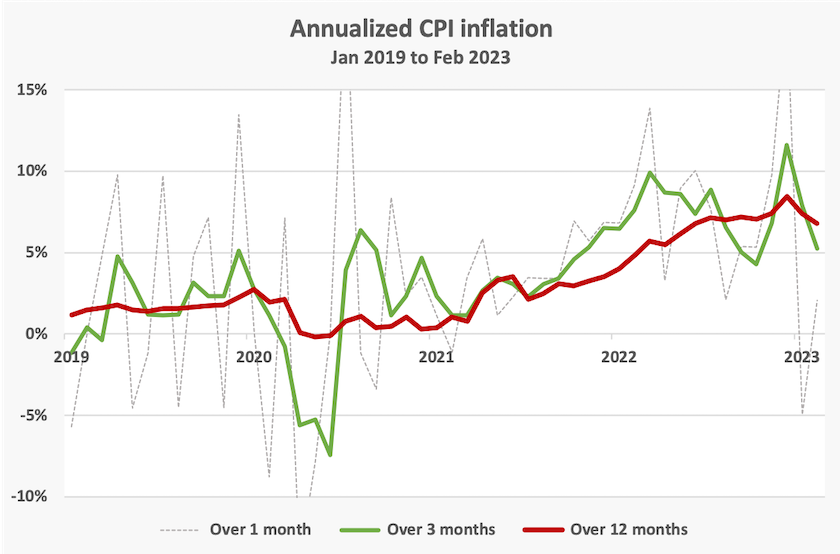

The graph below shows three annualized estimates of CPI inflation:

- over 1 month – the light gray line – pretty useless because it’s too noisy, occasionally shooting off the axis;

- over 3 months – the green line – less noisy, indicating inflation is now 5.3 percent;

- over 12 months – the red line – as used by the media.

This is not to suggest there is some definite figure for inflation, but it is to assert that the media’s categorical interpretation of the ABS data, that inflation is now 6.8 percent, is wrong. It’s actually an estimate of inflation comparing prices in February this year with prices in February 2022. Most of that is history, rather than an indication of what inflation is now, or is likely to be in coming months. A measure of inflation over the past twelve months makes sense for a union bargaining for a catch-up in an annual wage negotiation, but it is of little use for a central bank seeking an estimate of inflation in the coming months.

Does this misrepresentation matter? Not to the Reserve Bank: thankfully their staff have a much stronger grasp of mathematics than most journalists and would be doing something more sophisticated than looking back over twelve months. But one cause of inflation is a belief in the community that inflation is high: expectations of inflation are a cause of inflation. If people believe inflation is high they had better get their wage claims and prices in now. The media should not be contributing to such expectations by focussing on one high estimate.

1. The arithmetic: (((((117.9-117.7)/117.7)+1)^12)-1) = 0.021. ↩

No country for young people

Young people are having a tougher time than their parents and grandparents experienced in their youth. Today’s young people are generally in low-paid and insecure work – often paid below award wages. They are burdened with HECS debt, high rents, and housing ownership is unaffordable.

On the ABC’s The Money (first 19 minutes) Alison Pennington of La Trobe University describes how this situation has arisen. The root cause is neoliberalism, and the associated loss of collective institutions, particularly unions, to harness the collective power of workers to countervail the power of corporate interests.

In part this is a consequence of structural change: there are no longer the big establishments where workers were once concentrated. But it is also about the culture of individualism: many young people feel that their failure to prosper is because of some personal shortcoming rather than because of skewed power relationships.

Joining and becoming active in unions is a way young people can take control of their collective interests, but Pennington notes that unions have not gone out of their way to make themselves attractive to young people. She calls for tax reform, remarking that a dollar earned through hard work is presently taxed far more heavily than an unearned dollar received by those living off the returns to capital.

She calls for an effective wealth tax, as Thomas Piketty and many other economists have advocated. She also advocates more investment in public housing in order to make all housing more affordable.

Pennington is author of GenF'D? How young Australians can reclaim their uncertain futures.

Poverty in Australia

In partnership with the University of New South Wales, ACOSS has released the 20 th report on poverty in Australia – Poverty in Australia 2023: who is affected.

The researchers find that poverty is most prevalent in households where the main income-earner is either unemployed or not in the workforce. Recipients of unemployment benefits, parenting allowances, youth allowances and disability support payments, are heavily represented among households in poverty.

One may observe that this had been a depressingly normal situation for many years. But this report also notes how poverty dramatically increased as people lost paid hours during Covid lockdowns. Then, for a short time, the most severely affected households were given some respite when Covid-related income support measures were implemented.

This respite is more than a blip in a long-term time series: it is also a concrete demonstration that adequate income support can alleviate poverty – countering the right-wing assertion that the poor will always be poor because they cannot handle money and that cash handouts are de-motivating.

ACOSS recommends higher income support payments, a government commitment to full employment (what has happened to that Labor promise?), investment in employment services, and public investment in housing.

The report is rich in data, cross-classified by several dimensions. It should be an essential guide for policy makers and for those in advocacy and service delivery agencies.

But as with so much work on poverty, its almost sole concern is with income, using the established yardstick of households whose disposable income is X percent below the median income. (In this report X is 50 percent.) Only in relationship to house ownership is there any consideration in the report of the distribution of wealth.

We have developed excellent data sets on income, but apart from data on home ownership and patchy data on financial wealth, we know little about other dimensions of wealth inequality – human and social capital in particular. Nor is there much data on the related issue of spells in poverty. Human capital counts: someone with the capital of good qualifications and work experience, and with social connections, is likely to fare much better from loss of employment than someone lacking this capital, even if their incomes are the same.