Don’t cut spending, raise taxes

Even before AUKUS was developed, and before the fiscal response to Covid created a large government debt, Australia has been collecting far too little taxation.

Tax reform – paying for a strong and civilized society

Care for the aged, health care, public housing, defence, and transport infrastructure all require more public funding. There is also a large accumulated budget deficit – $930 billion gross debt, $570 billion net debt – left by the previous government.

The general story is that this debt results mainly from well-justified stimulus spending during the pandemic, but in fact, over the three years of the pandemic, 2019-20 to 2021-22, the deficit was only $250 billion. The Commonwealth budget has been in deficit since the global financial crisis of 2008-09, resulting in a slow build-up of government debt.

This is not to suggest that there is something intrinsically bad about a budget cash deficit or public debt. Like any enterprise, governments can and should borrow to fund investments yielding future benefits, and governments have a particular responsibility to provide counter-cyclical relief during economic downturns and pandemics. But as the current government correctly points out, for all that deficit spending over the last 15 years, we don’t have much to show for it (apart, perhaps, from some high corporate profits). The government was spending, but it wasn’t collecting enough tax to cover its spending.

Much of the explanation for that situation can be traced to an obsession that Australia’s taxes – at the Commonwealth level at least – should not exceed a certain level. The Coalition government set that level at 23.9 percent of GDP, as described in a 1998 article by the Grattan Institute, which asks “why 23.9%?” and fails to find any convincing answer.

That cap has been supported by a deliberately-circulated lie that Australia is a high-tax country.

That is indeed so if we compare ourselves with countries like Mexico, Turkey, Hungary and other less prosperous countries as can be found in a comparison made by the Centre for Independent Studies.[1]

The USA is often trotted out as a country for comparison, because their taxes are lower than Australia’s, but so too is the quality of their public services, and they have been running huge fiscal deficits, between 5 and 10 percent of GDP over the last ten years. Their fiscal debt now stands at about 170 percent of GDP, double ours of 84 percent of GDP. Some time in the future, when governments and private investors in other countries stop lending to the US government, the US will have to raise taxes substantially or run down its public sector even further.

If we are to engage in international tax comparisons we should do so with similar prosperous “developed” countries. That’s because as a country’s income rises its need for public goods and services grows faster, particularly for labour-intensive public services like health, aged care, education and policing. These are sectors that, by their very nature, cannot enjoy the labour-productivity gains enjoyed in most of the public sector. If the standard of public services is to be maintained as a country grows in prosperity, public spending has to grow even faster, and that means, over time, taxation has to rise as a proportion of GDP.[2]

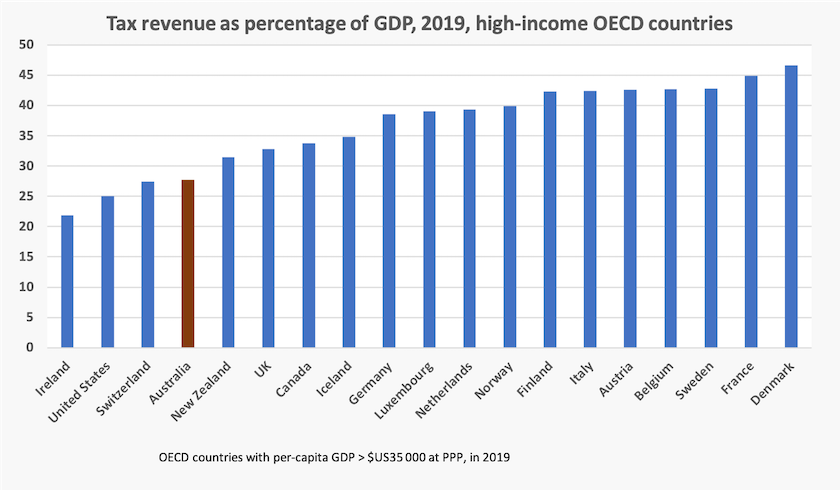

If we compare our taxes with other high-income OECD countries, we find we are down near the lowest-taxing countries, as shown in the graph below.[3] Besides the USA the other countries below ours are Ireland and Switzerland, both tax havens.

The immediate case for collecting more tax is the need to let fiscal policy take on some of the task of reducing demand. That would allow the Reserve Bank to back off its anti-inflation crusade, and would ensure that whatever sacrifices people have to make to contain inflation could be more targeted at those who can afford to pay. In this context it is hard to see any justification for the Stage 3 tax cuts.

But raising taxes is politically difficult. To quote a former leader of the federal Liberal Party calling for tax reform, “a major constraint on tax reform has been the expectation, fostered by the Coalition, that tax reform equals lower tax”.

That’s John Hewson, writing in the Saturday Paper: Why sweeping tax reform is urgently needed. He strongly supports the government’s changes to taxation of superannuation pensions, and he calls for similar progressive reforms elsewhere in our taxes – reforms that will collect more revenue, improve allocative efficiency and make the system fairer. He hits out at the “sustained whingeing” of the so-called business community, who call for a reduction in our headline 30 percent corporate tax rate, while failing to acknowledge that, mainly because of imputation, our actual corporate taxes are among the world’s lowest. (Imputation favours domestic investors over foreign investors, a point not understood by those who call it a tax benefit for the rich.)

He notes that Australia is heavily reliant on income tax in comparison with other countries. That’s correct, and as our life patterns move away from the model of steady, or slowly-rising incomes over our working lives, we need to re-think the appropriateness of progressivity relying on one’s earning over a one-year accounting period. (The Robodebt issue reminds us that that model may be getting past its use-by date.)

Hewson also remind us, correctly, that Australia is much less reliant on consumption taxes than other countries. People identifying themselves as on the “left”, and spokespeople for welfare groups, often protest at any notion that the GST should be raised or widened in scope (like the business community whingers), without acknowledging that a comprehensive package of tax reform that includes a higher GST can be more progressive when considered as a package. For one thing GST is a tax that wealthy superannuants find hard to avoid. And if they want an example from countries with solid social-democratic credentials, Norway, Denmark and Sweden all have VAT rates of 25 percent.

But the Coalition is unrelenting in its messages about tax. Opposition leader Dutton is suggesting the government’s submarine commitments should be funded by expenditure cuts, rather than by increased taxes: he nominates cuts to NDIS as an example. Australia is already suffering the economic consequences of the “small government” obsession, with deficits in our human and physical capital, and a level of economic unfairness that, if sustained, will threaten our social solidarity. If he is sincere about Australia’s long-term security he would desist from such economic irresponsibility.

It is notable that the idea we are a high-tax country has been losing ground in recent years. According to the Per Capita tax surveys, in 2017 just over half of the respondents agreed with the proposition that in comparison with other developed countries, Australia is “a high-taxing-big-government country”. By 2021 that percentage had fallen to less than 40 percent. Around half of Australians report that they are willing to pay higher taxes for better health and aged care, and about a third would pay more taxes to support education.

As Hewson and others have stressed, tax reform is hindered by brat journalists who ask politicians “will you rule tax X in or out”, where “X” is usually an increase in GST, a road user tax, or some other tax that, on its own, is unpopular. The task for politicians and for responsible journalists is to get people thinking about tax reform more widely.

There is also the political assumption that the well-off will rise in revolt against any progressive tax reform requiring them to pay more tax. Behind that reasoning is the offensive assumption that anyone who has enjoyed good fortune is greedy and deficient in his or her sense of social morality. That assumption needs testing, as Crispin Hull points out, noting that some of Australia’s most materially wealthy people favour more taxes on the rich.

In this regard it also notable that the Per Capita survey linked above reveals that Australians are becoming more understanding about public debt. Successive surveys show that an increasing proportion of respondents understand the analogy between government borrowing for investment and households taking out a mortgage to fund their houses. People may be starting to see through the Coalition’s deceitful messages about public finance.

1. Often those making comparisons choose all OECD countries as a base, possibly because of the impression that the OECD is a club of rich countries, but as a result of recent expansions in its membership the OECD now includes several low-income countries, such as Colombia and Mexico. ↩

2. This is recognized as the Baumol effect after the economist William Baumol. ↩

3. Although 2020 and some 2021 figures are available I have chosen 2019 because Covid-19 had a disproportionate effect on some countries’ income, and some countries responded with tax cuts while others responded with spending. Tax figures for 2020 and 2021 are therefore way off trend for some countries. I chose $US 35 000 per-capita GDP as a cut off for “high income countries”: Australia is in the middle – position 9 – among those countries. ↩

Capital gains tax quietly comes back on the agenda

A basic principle of economics is that unless there are compelling reasons to do otherwise, such as externalities, income from all sources should be taxed the same way. That’s a principle of tax neutrality.

Investments yield income in two ways. One is through cash flows – dividends on shares, interest on deposits, and rent on real estate. They also result in capital gains (or capital losses) fir investors. If your BHP shares go up over the year from $40 to $45, that’s the same as a $5 dividend in terms of your financial welfare.

One of the most significant reforms of the Hawke-Keating government was to apply the principle of tax neutrality to capital gains. Under those reforms capital gains were taxed when investors realized their assets. That is, when they sold their shares or real-estate. Because some capital gain is simply an artefact of inflation, for taxation assessment capital gain was assessed on the real (CPI inflation-adjusted) capital gain. If you had bought your BHP shares for $30 a few years ago and there had been 20 percent inflation since you bought them, their purchase price would be assessed at $36. If you sold them for $45 your taxable capital gain was $9 ($45 - $36).

In 1998, reportedly because Treasurer Costello couldn’t handle the mathematics of indexation, the Howard government abandoned the Hawke-Keating reforms. They abolished indexation, and assessed capital gains only on 50 percent of the nominal increase in value. Using the example above, your capital gains tax would be assessed on an income of $7.50 – 50 percent of $15 ($45 - $30).

These changes privileged short-term investments, while comparatively disadvantaging long-term investments because of the lack of indexation. The changes were welcomed by the finance sector, which has an interest in taking commissions from asset turnover, and was in line with the fad of “financial dynamism” – i.e. speculation.

Labor went to the 2019 election with a half-baked idea of applying only a 25 percent discount to nominal gains instead of the present 50 percent. This would have worsened the incentive for speculation over patient investment – it competes with its imputation proposals for economic dopiness.

Writing in the Conversation, Peter Martin proposes that capital gains taxation be considered once more: Working Australians pay tax in real-time – now the richest Australians making capital gains should too. He notes that one of the less-publicized changes the government has made to superannuation is to tax capital gains made in superannuation funds annually, rather than when assets are sold. (This applies only to superannuation funds with more than $1.9 million in assets.) He cautiously suggests that the same principle could apply to all investments, not only those in superannuation funds, including shares and investment properties, noting that such a system operates in Denmark.

There are many details to be considered. Abandoning the principle of taxation only on realization would cause cash flow problems for some investors. How are capital losses to be considered? Should gains resulting from inflation over the year be disregarded? These would all have to be dealt with in a Parliamentary committee or a Productivity Commission inquiry.

Martin’s important contribution is to bring the principle of tax neutrality into consideration once more – a principle abandoned by the Howard government and disregarded by Labor in opposition and government in recent years.