Public policy

The Uluru Statement from the Heart – progress

It’s taken 234 years, but we may be on the way to build into the Australian Constitution a recognition that people have lived on this land 65 000 years.

Albanese’s speech at the Garma Festival establishes the context of the proposed constitutional amendment, implementing the Uluru Statement from the Heart.

Most attention has been on the proposal for a Voice to Parliament. Albanese announced that the question to appear on the ballot papers will be “Do you support an alteration to the Constitution that establishes an Aboriginal and Torres Strait Islander Voice?” That will refer to the addition of three sentences to the Constitution, proposing that:

- There shall be a body, to be called the Aboriginal and Torres Strait Islander Voice.

- The Aboriginal and Torres Strait Islander Voice make representations to Parliament and the Executive Government on matters relating to Aboriginal and Torres Strait Islander Peoples.

- The Parliament shall, subject to this Constitution, have power to make laws with respect to the composition, functions, powers and procedures of the Aboriginal and Torres Strait Islander Voice.

Albanese said that the precise wording will be finalized after further consultation, and that the referendum will take place during this term of Parliament.

He is realistic about the difficulty in amending our Constitution. It needs a majority of voters nationally and in a majority of states (at least four of our six states). Broad support from political parties is important. He reminded us that in 1967, when there was a referendum to amend the Constitution to allow the Commonwealth to make laws for Aboriginal people and include them in the census, every member of the Commonwealth Parliament supported the proposal. The amendment gained a 91 percent “yes” vote.

Albanese anticipated that some may argue against the current proposal because improving the living conditions of indigenous Australians should have a higher priority, when he said:

Australia does not have to choose between improving people’s lives and amending the Constitution. We can do both and we have to.

Also at the Garma Festival Minister for Indigenous Australians Linda Burney mentioned that the Uluru Statement is not only about a constitutionally enshrined Voice to Parliament: it also refers to a Makarrata commission for truth and treaty.

In a 15-minute interview on ABC Breakfast, on the day before the Garma Festival, Marcia Langton described the struggles that have led up to the idea of a Voice to Parliament, including the work in developing and following on from the Uluru Statement, such as the work reported in Noel Pearson’s A rightful place: a road map to recognition.

In response to the claim that the idea of a Voice is not adequately thought through, and that details have not been described, she referred to the report Indigenous Voice Co-design Process which she authored with Tom Calma, and which was presented to the Commonwealth in July last year. It provides a great amount of detail on the consultations in developing the idea of a Voice and its general design principles, but not much about what it will look like, such as its governance and the channels by which it will put its views to government.

On Late Night Live, Age journalist Jack Latimore filled us in a little about what transpired at the Garma Festival. While the Voice to Parliament can be established with a referendum, probably late in 2023, a commission for truth and treaty may take many years – although some are pressing for it to be established at the same time as the Voice. He acknowledged people’s desire to see details about how it would operate.

The precise working of the Voice would be determined by legislation, he explained. The Constitution should not be too prescriptive, but it would be useful if proponents for the Voice could put up some models, so that people have some more concrete idea about what they are voting for (or against). (15 minutes, including a eulogy for Archie Roach)

As Crispin Hull points out, the way the Voice operates will evolve over time, and it would be rash to pre-commit anything too much at this time: Big 3 issues: something better than nothing.

Langton is particularly critical of the idea, expressed by some who oppose the idea of a Voice to Parliament, that it would constitute a form of racial discrimination. Her rebuttal is strong:

We have long had to tolerate this kind of structural racism that treats us as a “race”. You’ll notice that all of their arguments are based on the concept that we’re somehow a race of people, and that no race should have any more rights than any other race in Australia.

That’s a complete furphy and it’s been dealt with so many times.

We’re not a “race”. We’re over 600 cultural groups in this country with our own language traditions. We are the people who are descended from our ancestors who came here through thousands of years dating back to 65 000 years. This was our land until 1788 and this is where all of our traditions and cultures come from – from thousands of years of existence here. We’re not a “race”: we’re the peoples of this land.

She reminds us that the idea of “race”, common in the 19th century and still held by many today, has no scientific basis. Science, however, hasn’t gotten in the way of Andrew Bolt warning us that the government is planning to divide us by race.

“Race” may be a discredited idea, but there is still a clause in the Constitution, (Section 51 xxvi), giving the Commonwealth the power to make a law with respect to “the people of any race for whom it is deemed necessary to make special laws”. This was examined in some detail by a House of Representatives Committee in 2008. The committee agreed with an earlier finding that it was “outmoded” and “odious”, and that its repeal would be unlikely to attract opposition. It also noted that with the passage of anti-racism legislation, and the ambiguity around idea of “race”, the clause was redundant.

It appears that the government does not want to use this occasion to clean up this part of the Constitution. Perhaps the government wants to keep it simple – the issue of the Constitution being cluttered with transitional provisions, and some archaic concepts, is a separate one.

That interest rate hike – is it about inflation or about something more basic?

“Inflation is expected to peak later this year and then decline back towards the 2–3 per cent range”.

That’s an extract from the Reserve Bank’s statement on its decision to lift the cash rate target by 50 basis points, to 1.75 percent.

That statement begs the question, if inflation is bound to fall, why not sit back and let this wave of once-off price rises go through and settle down? After all, there is no evidence of self-sustaining inflation.

Writing just before the RBA decision, Ross Gittins warned that inflation is a small problem that should not be attacked with a sledgehammer. Many price rises faced by households, such as energy prices, are from cost factors that will not be affected by changes in the availability of money.

Peter Martin, writing in The Conversation, also asks why the RBA is so concerned. He believes that the RBA is anticipating very strong short-term inflationary pressures, and notwithstanding the outlook for inflation to fall in the medium-term, is determined to take strong action now: Why does the RBA keep hiking interest rates? It’s scared it can’t contain inflation. Martin notes that in the June quarter CPI there were price rises almost across the board, not only in specific items subject to once-off pressures.

He also notes that the RBA is guided by a more sophisticated model than simply clobbering the economy to stop inflation. It wants to increase the reward for saving, and to push up the exchange rate – a move that would ease price pressures without causing short-term hardship (but that has widespread macroeconomic costs if it hurts competitiveness of our trade-exposed industries).

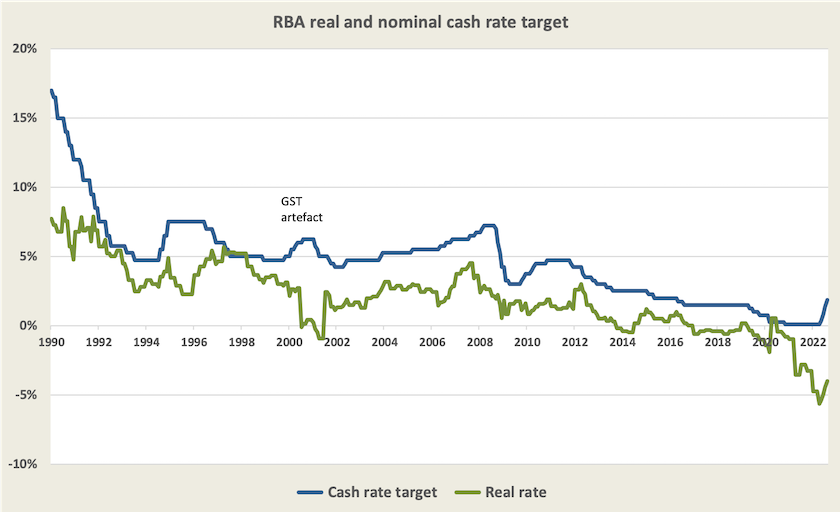

The RBA’s priorities seem to relate to the need to bring the real interest rate (the exchange rate after inflation) back to positive territory. Reducing inflation may be a means to an end – a positive real rate – rather than an end in itself. Negative or very low real interest rates are undesirable because they fuel asset price speculation and over the medium term they worsen wealth inequality.

This all points to the need for the review of the RBA’s charter to be more about keeping the amount of money in the economy in balance with the economy’s productive capacity, rather than meeting some arbitrary inflationary target. That’s a fairly conventional economic model. Speaking on the ABC’s The Money program, Warwick McKibben offers a slight variation when he suggests that the central bank should set interest rates so as to regulate the amount of spending in the economy. Traditional inflation-targeting may work for demand-side shocks, but if there is a supply-side shock, as is occurring at present, it is better that the central bank accept inflation as a given, and regulate the amount of spending so that it matches nominal GDP (expected inflation + real GDP). (McKibben’s contribution, which includes an analysis of recent interest rate movements, starts at 06:50 and runs to 17:30 on Thursday’s The Money program.)

It’s a difficult task, particularly in an economy exposed to as many shocks as ours has been during waves of the pandemic, the usual swings in our terms of trade, and now a war. It’s also difficult because whatever the textbooks suggest, in a country with a strong banking sector the central bank is not the only body controlling the money supply. There may have to be some integration of the central bank’s operations with bodies responsible for prudential regulation.

What the economy probably needs right now is a hefty increase in nominal wages but don’t expect any government minister or public servant to suggest anything of the sort – it’s too heretical. But a nominal wage increase would reduce the real burden of mortgage debt (just as inflation did for baby-boomers in the 1970s), it would allow some extra revenue from those income tax cuts, taking advantage of bracket creep, and it would increase revenue from capital gains taxes because in 1999 the government abolished indexation of capital gains tax. Such a nominal wage increase would retrieve some good from two economically irresponsible Coalition policies.

Our failing capital market

Pick out the odd two companies from this list of ten largest firms (by market capitalization) listed on the Australian Stock Exchange: BHP, Commonwealth Bank, Rio Tinto, CSL, National Australia Bank, Westpac Banking Corporation, Macquarie Group, ANZ Bank, Woodside Petroleum, Wesfarmers.

The two odd firms are CSL and Wesfarmers; they are actually involved in value-added goods and services. Of the other eight, five are financial firms, and three are involved in extracting resources. If we look at our fifty largest firms by market capitalization, 38 percent are classified as “financials” – 46 percent if we classify “real estate” to the financial sector – and 18 percent are classified as “materials”. That leaves only 36 percent of those firms primarily involved in real value-adding – that is doing something other than shuffling money around in the transactional economy or extracting stuff out of the ground.

That doesn’t mean we have few firms providing value-added goods and services, but it may be hard to find them listed on the stock exchange. On last weekend’s Saturday Extra Geraldine Doogue discussed with Jason Zein, of the University of New South Wales Business School, the decline of the stock exchange and the corresponding boom in private markets.

There is venture capital flowing into firms with promising futures, but not through the stock exchange. Rather, it is coming through private equity, into unlisted firms. Investors in the ASX are generally too eager for short-term returns in the form of dividends, but firms in the industries with long-term growth, such as renewable energy, have to rely on patient investors who can expect firms to make calls for capital contributions and will not pay dividends for many years.

This means that opportunities for Australians to invest in our long-term growth are limited. Although some large superannuation funds have access to private equity, most people, apart from a tiny number of “high net wealth individuals” (HNWIs), have to content themselves with the old, established firms on the ASX. As Thomas Piketty points out, when opportunities for productive investment are open only to HNWIs, the distribution of wealth is likely to become even more distorted than it is now. (15 minutes)

We may ask if the failure of our stock exchange to cater for patient investors results from distortions introduced by successive Coalition governments under pressure from the finance sector. Of note are the 1989 “reforms”that abolished capital gains tax indexation and halved the rate, to encourage short-term speculation and discourage long-term patient investment, and other tax incentives for people to engage in real-estate speculation.

Gas – we can have what’s left over, if we are willing to pay for it

The Australian Competition and Consumer Commission (ACCC) in its Gas inquiry July 2022 interim report has put some hard numbers around what is well-known about the gas industry: because of a high world price, elevated by the Russia-Ukraine war, gas producers in Australia are enjoying massive profits on export markets, while putting our own energy security in jeopardy, and imposing the hardship of higher gas prices on households and industries.

The figures in the ACCC report show that the gas producers have export contracts to supply 1299 Petajoules next year, and the capacity to produce 1981 PJ, which should leave enough (682 PJ) to provide the Australian market, which requires 571 PJ next year – 445 PJ for domestic and industrial use, and 126 PJ for electricity generation. But the companies expect to export 167 PJ above the 1299 PJ they have contracted, leaving the domestic market short by 56 PJ. The ACCC also finds ineffective competition in pipeline transmission and between gas producers.

The ACCC notes that there are two measures available to the government. One is the Australian Domestic Gas Supply Mechanism (ADGSM), essentially an export control, and the other is a negotiated agreement with the gas companies. The ACCC notes that there are complexities in both measures, and recommends that the government should initiate the first steps of the ADGSM and should give Australians the first option to buy the uncontracted gas. (Think about that for a while: foreigners are privileged, while Australians have to beg these firms to buy Australian gas to be used by Australians, even though gas is in ample supply.) The government has accepted the ACCC’s recommendations.

Tony Wood of the Grattan Institute summarises the ACCC report and the government’s response, and recommends that the government go further by applying a super profits tax: Pull the gas trigger – and levy a super profits tax too. Why should Australians face a gas shortage and pay a high price for our own gas, while private firms rake in the benefits from wartime profiteering?

Sophie Vorrath, writing in Renew Economy, says that the companies are throwing away their social license, and that they should be subject to a carbon tax on exports. In an article co-authored with Giles Parkinson – There is no shortage of gas, or fossil fuel cartels, in Australia – she quotes extensively from Bruce Robertson of the Institute for Energy Economics and Financial Analysis, who urges the Australian government to take stronger action to bust energy cartels, and should establish a permanent domestic gas reservation policy.

While the ACCC is a little coy about the extent of profiteering, the ACTU has dug into tax data relating to the four energy giants – Shell, Chevron, Exxon Mobil, and BP – revealing that in 2019-20, while their revenue from Australian operations was $55 billion, only one of them paid any Australian company tax, a paltry $352 million: Oil giants’ sky-high profits fuels cost of living crisis. Their revenue this year would be much higher.

Taking a world view, UN Secretary-General Guterres, notes that in the first quarter of this year major oil and gas companies have reported profits of $US100 million – a situation he calls “immoral”. He urges nations to tax these companies and use the proceeds to help poorer countries make a transition to renewable energy.

The ABC’s Ian Verrender provides a general background to the present gas supply and pricing problems in Australia: What the government should do to rein in soaring power prices as some bills go up 18 per cent. He summarizes the politics of the situation:

Just a few months into power, the Albanese Government doesn't want to appear to be engaging in knee-jerk reactions. And, during the Rudd-Gillard years, Labor learned the hard way just how much damage can be inflicted when you go head-to-head with major business interests.

If we had an opposition concerned with offering ideas for public policy, rather than with its own claim to take the reins of power, the government would be able to use its taxing and regulatory powers to bring down gas and electricity prices very quickly, while helping to pay down government debt. But as successive Coalition prime ministers – Howard, Abbott, Morrison – have demonstrated, the Coalition’s path to office lies in discrediting and misrepresenting its political rival, and does not consider that it should be impeded by minor considerations such as the public interest in energy security.

Productivity: work smarter, not harder

Shakespeare’s will, written in 1616, specified that his wife, Anne Hathaway, was to inherit his “second best bed”. The Shakespeare Birthplace Trust explains that “a bed was an expensive and luxurious item, generally regarded as a valuable heirloom to be passed down the generations rather than given to a surviving spouse”.

We don’t know the price of a bed in 1616, but the Productivity Commission has calculated that in 1901 in Australia it took 185 hours of work to pay for a double bed with a mattress, blanket and pillows. In 2019 it took only 18 hours.

That’s one of many illustrations of the extraordinary long-term gains in productivity – our ability to produce more with less effort – in the Commission’s interim report 5-year Productivity Inquiry: The Key to Prosperity. It’s the second report in a five-yearly series, the first report, Shifting the Dial, having been presented in 2017.

This report is written for a wide readership. Even the reader with only the haziest ideas about economics, won’t find it too scary. In fact it could be considered as a basic economics text, with practical illustrations about beds, bicycles, and cars with heated seats, rather than all those bamboozling supply/demand curves.

Economist Paul Krugman said “productivity isn't everything, but in the long run, it's almost everything”. The Commission has a slightly more detailed explanation:

Productivity growth — producing more outputs, with the same or fewer inputs — is the only sustainable driver of increasing living standards over the long term. While economic growth based solely on physical inputs cannot go on forever, human ingenuity is inexhaustible.

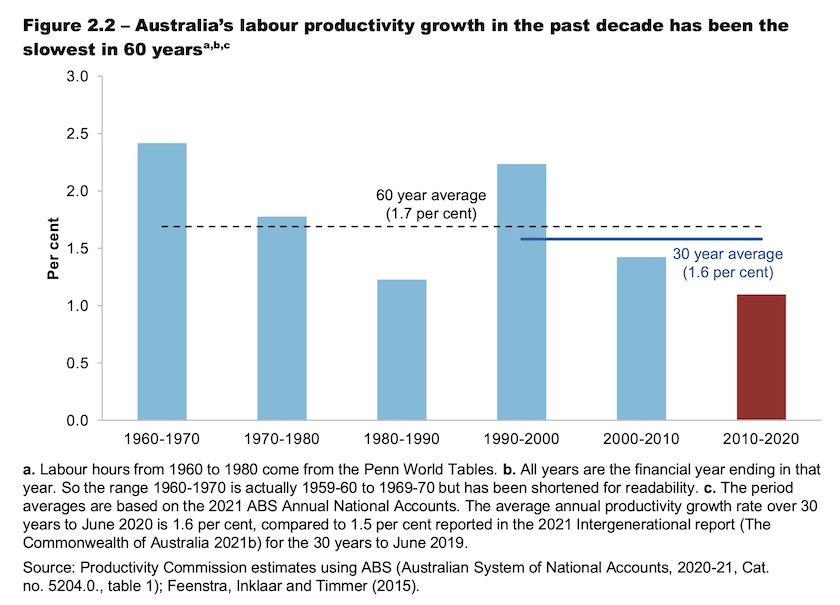

Without productivity growth, real wages cannot rise, and one of the main reasons real wages have stagnated is that productivity growth in Australia, and in many other “developed” countries, has fallen, as shown in the graph below, taken from the report.

The Commission offers one theory that may explain the decline in productivity growth. Those long-term gains in productivity have been mainly in the production of goods, as the grunt force of labour has been replaced by capital equipment, and as innovation has made new and higher-quality products available. Many services, however, are intrinsically labour-intensive. It’s harder (but not impossible) to find productivity gains in teaching or serving meals than it is in printing books or in producing a loaf of bread.

This report only touches on other specific reasons for our poor productivity performance, and does not go far into recommendations for improvement. They will be the subject of reports to be published in the next few months, after consultation with interested parties. The Commission repeats and updates some of the findings and recommendations from the 2017 Shifting the Dial report on health care (where much better resource allocation could be achieved), education (the importance of lifelong learning for example) and other areas of economic activity. One finding that wasn’t in the 2017 report relates to de-carbonization and the need to account for the cost of emissions:

Decarbonising represents an effort to reduce costs – specifically the cost of carbon emissions not hitherto counted in firm profits or GDP. It will require global and local innovation, strong partnerships between the public and private sector and significant new investment – partly to replace rather than add to the existing capital stock. Australia’s success in meeting this challenge efficiently will be a key determinant of our overall productivity performance in coming decades.

As the Commission delves into other reasons for our poor productivity performance it will have to confront the way successive governments and the media have allowed economic management to become understood in the public mind as fiscal management, focussing on the budget balance and government debt, while neglecting the far more difficult task of structural reform.