Public ideas

Privatization and corporatization – how did such stupid ideas take hold?

When the Australian Energy Market Operator suspended the electricity spot price operation on Wednesday it not only hit back at unscrupulous firms withholding supply in order to maximize profits, but it also demonstrated the fundamental failure of the National Electricity Market. The NEM is a creature of the neoliberals’ “small government” obsession, an obsession that has seen well-functioning public utilities replaced by a horrendous set of arrangements that reward profiteering, compromise reliability, retard the development of new power sources, incur massive administrative costs on both the public and private sectors, and load the costs on to electricity users.

The risk of blackouts is only one of the NEM’s failures. From next month electricity prices will rise by around 10 percent or even more in some places, with only the ACT (locked into long-term renewable contracts) and Western Australia (not in the National Electricity Market and with gas reservation) pretty well exempt from the price rises.

For many these rises will largely wipe out the reductions in electricity prices we have enjoyed over the last four years – reductions that have come about as more (but not enough) renewables have come on stream and as there has been some tightening of the profit (but not enough tightening) allowed to the monopoly owners of transmission lines.

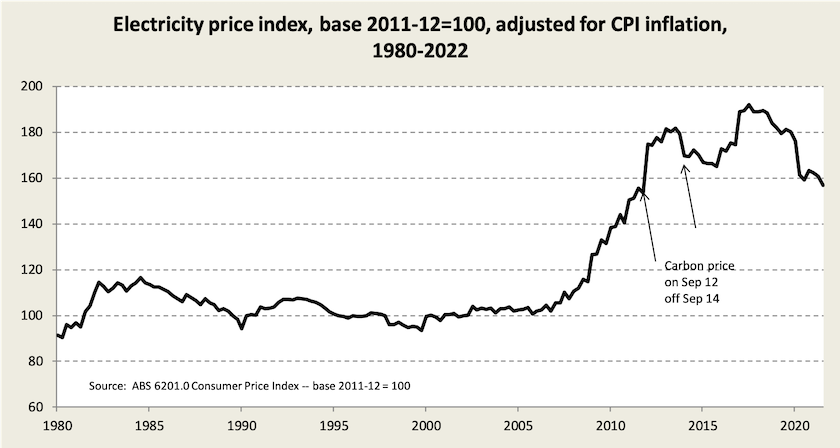

The graph below shows real (inflation adjusted) electricity prices over the last 40 years, up to the March quarter this year.[1] A ten or fifteen percent rise will not push prices to their 2017-2018 highs, but at a time when real incomes are falling, they will still hit many households hard.

The graph also reveals the huge rise in prices starting around 2005, topped off by the short-lived carbon price, which is no more than a blip in a longer-term trend.

That rise from 2005 coincided with the development of the NEM which was cobbled together as an aspect of competition policy around 2000. Some of the rise was inevitable, but much of it results from replacing our well-functioning utilities with the NEM.

The NEM had two sensible aspects. One was the interconnection of states’ high-voltage transmission networks.[2] The other was to de-couple the generation of electricity from its other components – transmission, distribution and retailing. For the best part of a century electricity generation had been in large coal-fired and later natural gas-fired power stations owned by the utilities. Because low-cost solar and wind plants were coming on stream, and because the grid was serving five states, it made sense for the lowest-cost suppliers, rather than the power stations previously linked to one state’s grid, to be prioritized for supply.

But not content with this reform, ideological zealots who didn’t know the difference between a volt and an ampere, and who were infatuated by the simplistic economic models of perfect competition, used the NEM to break up the rest of the electricity industry into its components. Transmission and distribution were to be corporatized and preferably privatized, and selling the final product was to be subject to competition by companies who would buy electricity wholesale and re-sell it to consumers, supposedly levelling out the movements in wholesale prices. And the choice of generators to supply the grid, rather than being controlled by a least-cost allocation system, was to be left to a largely de-regulated market, with complex rules to ensure reliability and stability.

All in the name of “competition”, what had been done by well-functioning vertically- integrated state-owned utilities is now done in a fragmented set of entities. The transmission and distribution businesses are profit-making corporations, who are allowed a private sector return on capital rather than the much lower government bond rate the utilities used to pay, and who pay high salaries to their managers. There are also the costs of a public sector regulatory mechanism and armies of lawyers employed in disputes between these corporations and the regulators. Then there are the “retailers”, all incurring the costs of marketing while offering a few piffling savings to those few consumers who have the time and computational capacity to shop around, subsidized by other consumers. All of this involves transaction costs between different businesses – costs that used to be minimized or non-existent in the state-owned utilities. Only Western Australia has been exempt from this ideological idiocy, as explained by Western Australia’s Energy Minister Bill Johnston on the ABC last week.

We are experiencing the consequences of this neoliberal dogma, and plenty of people are commenting on it. As South Australian Premier Peter Malinauskas put it on the ABC, we’re witnessing market failure on a grand scale in a way that policymakers should be deeply ashamed of. The energy market structure is completely wrong. The NEM may have brought opportunities for private operators to make profits by exploiting market power, but it has failed the basic economic test of serving customers – households and businesses. (13 minutes). Malinauskas is followed by Financial Review journalist Phil Coorey who agrees that our energy system is a complete and utter market failure, and he sheets the blame to past state and federal Coalition governments. (5 minutes)

This isn’t some analysis done from the high ground of hindsight. Five years ago Clarke and Dawe were able to explain thes waste and idiocy in the NEM and alert us to forthcoming problems. But economists living in the abstract world of freehand supply and demand diagrams can’t shake off their faith in the magic of markets. Just this week highly-qualified economists at MIT have published their amazement, distress even, when their research revealed that de-regulation of US electricity utilities has resulted in increased prices because firms were exercising strong market power, the cost of which has far outweighed minor improvements in cost efficiencies. Any engineer could have told them that would happen.

It is natural that we should seek out who is responsible for our current difficulties. Indeed it is important that the Liberal Party, if it is to survive, learns a little basic economics from this experience and shakes off its contempt for and hatred of the public sector.

But the issue goes beyond partisan politics. Writing in Renew Economy, where he has many articles about our present troubles, Giles Parkinson takes the Queensland Labor government to task for its publicly-owned companies having withheld electricity supply so as to maximize profits. Corporatized government businesses – entities directed to act as if they are private companies rather than public utilities – can be just as irresponsible and rapacious as the worst of private firms.

Those who worked in the old state-owned electricity companies knew that there were sound reasons why they operated as public utilities. They understood the costs and limits of competition. They knew that electricity is an industry supplying a basic commodity using long-established technologies: there is little opportunity for privatization to bring process or product innovations to electricity. But they had no voice at the tables where the NEM was crafted by market zealots whose knowledge of the industry did not extend beyond changing light bulbs.

What we are witnessing goes beyond Liberal-Labor or “right”-“left” ideological differences. Rather it is a consequence of public policy dominated by people possessed by simple all-explaining ideas – communism, neoliberalism or any other creed that prioritizes abstract dogma over the real world of science and engineering.

1. Because electricity is a large component of the CPI this is slightly self-referential.↩

2. he NEM includes South Australia but not the Northern Territory and Western Australia.↩

The fortunes of a well-located rich country

How does a small, prosperous “developed” country in the Asian region see itself? As an outpost of Europe, or as a country with good fortune?

In a short statement at the World Economic Forum in Switzerland, Singapore diplomat Kishore Mahbubani remarked on “three significant blessings” Singaporeans have enjoyed at a time of great global turbulence.

One is its success in managing Covid-19, a success he attributes to the country’s remarkably effective public service.

The second is its location, in one of the world’s most ethnically diverse regions, which has enjoyed 40 years of peace.

The third is East Asia’s embrace of free trade, while the country that taught the world the virtue of free trade, the USA, is turning inwards. He mentioned specifically the Regional Comprehensive Economic Partnership Agreement, which came into force at the beginning of this year.

(Australia and Singapore have very similar outcomes for Covid-19 and are both members of the RCEP.[3]

3. Singapore has had 260 Covid-19 deaths per million population, while we have had 350 deaths per million. These are an order of magnitude smaller than the rates in the UK (>2600) and the USA (>3000).↩