Weaponized economic data

Wages: one for Labor

The Wage Price Index, released on Wednesday, confirmed what many people already know from their own experience: real wages are falling. Over the year to the end of March 2022 nominal wages rose by 2.4 percent, while CPI inflation was 5.1 percent, and over the March quarter nominal wages rose by 0.7 percent while the CPI rose by 2.1 percent. These correspond to a real fall of 1.4 percent for the quarter and 2.6 percent over the year. Over the year wages rose most strongly in the “renting, hiring and real estate services sector” (nothing beats a house price bubble for transferring money to commission agents). Also over the year and over the latest quarter nominal wages in the public sector rose more slowly than wages in the private sector. While the term “public sector” may conjure up images of bureaucrats in Canberra offices, it also covers nurses, teachers and many others in female-dominated service occupations.

Unemployment: One for the Coalition

On Thursday the ABS released Labour Force data, revealing an unemployment rate of 3.9 percent, unchanged from last month, but in terms of bragging rights the government can claim it is down from 4.0 percent as was reported last month. The explanation: the ABS has revised its figures, as it often does. Rounding conventions deprived the Coalition of its brag last month.

Any reasonable summary of this data, after one looks at minor changes in participation, hours worked, underemloyment and other indicators, would simply be “unchanged”. Little is ever revealed in month-to-month labour force data. Unfortunately, following the disruption of Covid-19, and the weird figures generated by “Jobkeeper”, the ABS suspended its trend calculations, which in normal times would give some indication of where employment is heading.

Alan Kohler explains monetary policy in two minutes

How does monetary policy work?

It’s simple: if prices rise quickly, the Reserve Bank responds by raising prices – the price of money, that is. And they go on doing this until they get inflation under control, precipitating a recession, if necessary. That’s because when there’s more money than stuff being produced, the price of stuff rises, and money has to be made more expensive to restore the balance between money and stuff.

Alan Kohler explains this on a short videoclip: With the Reserve Bank raising interest rates, could we see another recession?.

It’s pretty well straight Economics 1, with a little empirical data thrown in. He displays the RBA’s inflation predictions for this year, made in February, August and November last year, comparing them with actual inflation. The Bank was badly out in all three predictions. (Therefore why should anyone take any notice of election costings?)

Kohler is critical of the RBA: they could have done better. But the lesson we can draw from the RBA’s failure is the sheer difficulty of making such forecasts, as the world emerges from a pandemic-induced recession (it’s 100 years since we had one of these), as world supply chains are disrupted by a war in Ukraine and severe Covid lockdowns in China, and there are disruptions resulting from extreme weather events associated with climate change.

As Yogi Berra said, “it’s tough to make predictions, especially about the future”.

That interest rate rise was the first of many

“Members agreed that the condition the [Reserve Bank] Board had set to increase the cash rate had been met. They also agreed that further increases in interest rates would likely be required to ensure that inflation in Australia returns to the target over time.”

That extract from the Reserve Bank minutes of its May 3 meeting, when it decided to lift the cash target rate by 25 basis points, is the surest sign that the RBA will go on lifting rates until it is confident that inflation is within its 2 to 3 percent target range, which it does not believe will be the case until mid-2024, when supply-side disruptions are resolved.

The bank’s board and staff seem to have great trouble working out where the Australian economy is heading. They are not optimistic about the global situation because of high inflation and falling real wages in many countries, the effects of the Ukraine war, and China’s Covid-19 problems. They find it even harder to read the domestic economic situation: by the laws of economics wages should be rising, but they are not. (The Coalition’s policy of suppressing wages seems to have worked very well.)

Election costings – works of creative fiction

The Coalition – cut the public service but keep overpaid consultants

The Coalition released its pre-election fiscal costings on Tuesday.

Anyone who finds joy in reading accounting estimates and who has a half-day to spare can read the Coalition’s costings on the Finance Department website. Notably the Coalition has used the Finance Department to do its costings, rather than the more independent Parliamentary Budget Office.

The costing that has raised most media attention is “COA 036 – Agency Resourcing”, in which the Coalition proposes a two percent cut in public service departmental funding, presented under the euphemism “efficiency dividend”. This is explained by Tom Ravlic writing in The Mandarin: Coalition’s election costings requires departmental cuts.

Labor has been quick to note the likely effect on waiting periods for government benefits, and has contrasted the Coalition’s approach with its own proposal to reduce the government’s administrative costs by cutting back on the use of highly-paid consultants to do work once done at lower cost and more thoroughly by public servants. Callum Foote, of Michael West Media, points out that on the Coalition’s watch consultancy contracts awarded to the big four consultancy firms have reached almost $1 billion a year.

Labor – no apologies for borrowing to invest

Over the two days following the Coalition’s publication of its own estimates Morrison and Murdoch media journalists hectored Labor to release its costings, which they did on Thursday.

Labor’s costings are on its website: Labor’s plan for a better future: better budget, better economy. Labor plans to increase spending by $18.9 billion over the next four years while finding savings of $11.5 billion, a task that shouldn’t be too hard in view of the extraordinary waste incurred by the Morrison government. The net addition to the fiscal deficit would therefore be $7.4 billion.

It’s a detailed document with many small items of expenditure, a few large expenditures, and a few large savings. Some of the large expenditure items that stand out are directed to child care, aged care, TAFE, foreign aid to the Pacific, and strengthening Medicare. The main savings are in strengthening taxation revenue including $3.1 billion from a program called “Extend and boost existing ATO programs”. That is about cracking down on tax avoidance, a move that should do much more to improve revenue than Labor’s already-announced proposal to tax multinationals, which yields only $1.9 billion. Other savings come from less use of external consultants ($3.0 billion) and from abolishing a number of discretionary grants programs.

In view of the “trillion dollar” fiscal debt an incoming Labor government would inherit from the Morrison government, and the $340 billion by which the Coalition would increase that debt over the next four years, revealed in the government’s Mid-Year Economic and Fiscal Outlook, an addition of $7.4 billion has little more significance than a rounding error. Another way to see this debt is that it is around $740 per household. Or one can see that extra $7 billion in comparison with $2 736 billion of total household liabilities. (We do have a debt problem, but it’s in the private sector.)

If the Coalition wants to use that $7.4 billion to discredit Labor, it has little ground to stand on, particularly since the budget was already well in deficit before Covid-19 sailed into our country. But that hasn’t stopped the Murdoch media from emphasizing it, rather than the absolute level of public debt.

The most significant aspect of Labor’s costing, in comparison with the Coalition’s, is not the size or the plus or minus sign in front of small amounts, but the fact that Labor proposes a re-allocation of spending, whereas, apart from further reducing the public service’s administrative and policy capacity, the Coalition really has no plan.

Why are we (or at least some of us) so fussed about these estimates?

Peter Martin, writing in The Conversation, takes us through a history of pre-election costings, Elections used to be about costings. Here’s what’s changed, and explains why no one (other than Coalition politicians and partisan journalists) takes them seriously any more.

One reason, mentioned above, is that the massive deficit accrued during the pandemic, reduces the Coalition’s credibility to claim that “budget repair” (whatever that means) and a “balanced budget” are the most important aspects of economic management.

Another reason is that estimates of fiscal balances (the deficit or surplus), even in the absence of events such as pandemics, are fraught with difficulty. The fiscal balance is the difference between two estimates – receipts and payments – each with its own error of estimate, which means that the fiscal balance is subject to a highly-amplified error of estimate. While governments have some control over expenditure they have far less control over revenue, and both expenditure and revenue are dependent on the business cycle and the world economy.

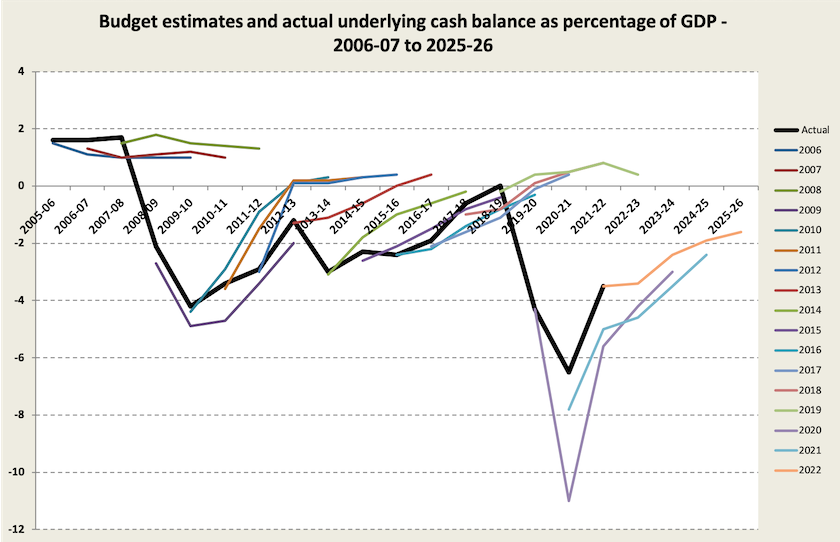

The graph below shows the difference between budget-time estimates of the fiscal balance (the “underlying cash balance”) in colored lines and the actual outcomes in a thick black line. If there were no difference the black line would cover all the coloured lines until 2022-23. No government gets it right.

Governments shouldn’t be criticized for getting these estimates wrong: they are not clairvoyants. But governments, oppositions and partisan journalists should be criticized for vesting these estimates with spurious accuracy.

The main reason for not getting too het up about the fiscal balance and costings is that they are only cash flow projections, with only minor accrual adjustments. They are not profit-and-loss statements or balance sheets, as a company is expected to present.

For the most part these fiscal estimates do not distinguish between capital and recurrent outlays, and many outlays classified as recurrent by accounting conventions are actually capital in nature. There is a huge difference between different types of expenditure: outlays for education and training, which yield long-term benefits and are therefore capital in nature; outlays for immediate consumption, such as pensions, and health care; and outlays that are just waste, such as $5 billion for submarines we will never get and extraordinary grants to firms under the Coalition’s “Jobkeeper” program – $89 billion of non-capital expenditure, providing no assets on the other side of the balance sheet, and indeed nothing enduring. Also, Commonwealth payments to the states for capital purposes are classified as recurrent rather than capital on the Commonwealth books.

What’s covered in pre-election costings are only fiscal costings, rather than economic costings. Fiscal management (i.e. managing budgetary expenditure and revenue) is an important aspect of economic management, but it is only one element. It is far more important that voters be able to assess Labor’s and other parties’ policies not on budgetary cash flows, but on how they affect the allocation of resources in the whole economy. Will they help or hinder productivity? Will they result in our economy becoming more or less internationally competitive? Will they move us towards or away from more equality in income and wealth? How will they play out in the longer term: will they sacrifice long-term prosperity in favour of higher incomes now? And so on. The Charter of Budget Honesty, introduced by the Gillard Government, and within which the pre-election costing system sits, was bad policy, because it prioritized fiscal management over economic management. It would have been far more helpful for public policy had it introduced a charter of economic honesty.

As Labor correctly states, figures on the size of public spending reveal nothing in themselves: what counts is the quality of that spending. It’s a valid point, in line with the principles of accounting and economic management. After all, as an investor in a company, a shareholder would not be dissuaded by a firm planning to incur more debt to invest in productive assets, but over many years Liberal Party treasurers have deliberately dumbed down the way we have become conditioned to think about public finance: deficits bad, surplus good.

Economic management is about far more than bookkeeping.