Australia’s enfeebled economy

The budget: a sugar hit followed by starvation

The budget is the most overrated event in the political cycle.

In fact the budget is simply “a bill for an act to appropriate money out of the consolidated revenue fund for the ordinary annual services of the government and for related purposes”.

You can’t get much more ordinary than that.

For a government that has neglected economic reform for almost its entire time in office, the budget is all it has left as an instrument of economic policy. About the only economic function it can serve is to help stabilize the economy through running a cash surplus or cash deficit to even out the economic cycle and to respond to events such as a pandemic or a global financial meltdown. Its secondary economic function is to tweak public expenditures, particularly the big demand-driven programs such as health and social security, to deal with population growth and inflation and other minor adjustments. Its other function that commands so much attention, particularly under Coalition governments, is political.

Chiltern, Victoria

Anyone who listened to the Treasurer’s speech will have heard his claims about “record funding” for all manner of government services. That’s just inflation and population growth. They will have heard his announcements about infrastructure spending – targeted at seats the Coalition seeks to win or hold. But as the New South Wales Government has warned, infrastructure projects have had to be held back because of a lack of physical capacity, including skilled labour. Budgets are about money, not real resources, and because the Coalition has neglected structural reform in the real economy, those real resources are not there. They will have heard his claim about fuel excise relief, claiming that because of a 22 cent per litre cut in excise, “a family with two cars who fill up once a week could save around $30 a week”. Really, how many families drive 1240 km a week?[1] But reality doesn’t count: the Treasurer’s speech isn’t about the real world; it’s simply a stream of announcements to do with impression management.

Those who seek a list of the deceptions in the Treasurer’s budget speech can find one compiled by the ABC’s factcheckers, but most deceptions are buried in the hundreds of pages of budget documents, and will be only slowly uncovered over coming days.

The budget’s main feature is a set of short-term expenditures, about $9 billion, over a few months covering the election and a little beyond. That’s about one percent of GDP, the level of expenditure one would expect in an economy going into recession, but not in an economy in the recovery phase, where there are already significant inflationary pressures, where the world is sloshing with liquidity, and where the Reserve Bank has already signalled its intention to raise interest rates.

That is not to suggest that the government should do nothing about cost-of-living pressures, but it is hampered by two constraints, both of its own making, that prevent it from doing anything sustained. One is its dogged “small government” ideology, and the other is its neglect of structural reform.

That first constraint is manifest in its obsession not to let taxes rise. The Coalition has created for itself a taxation ceiling – 23.8 percent of GDP, the taxation level in the last year of the Howard government. In fact the budget papers show that over the next four years Commonwealth taxes are not to rise above 22.9 percent of GDP.[2] Without this constraint the government could increase spending on health and education, invest in social housing, fund aged care adequately, invest money to strengthen our defences against climate change. It could do all this without adding to inflation because it could cover this expenditure with higher taxes, levied on those with most capacity to pay. But it has ruled out raising taxes, even though Australia’s taxes are close to the lowest among all “developed” countries.

The other constraint is a longer-term one, and that is the economy’s fundamental limited capacity to pay higher wages. Our long-term productivity performance is pathetic: GDP per hour worked, the basic indicator of labour productivity, has been falling ever since the Coalition took office in 2013. That, in turn, is because there has been hardly any attention to economic structural reform for the last 26 years – 20 of them on the Coalition’s watch. Starting with the Howard Government, the Coalition established in the public mind the idea that the only thing that counts in economic management is the fiscal outcome – the budget’s cash deficit or surplus. That focus has allowed the Coalition to claim to be the better economic manager, because until the pandemic hit it has held office in easy times when the business cycle was expansionary, and something sounds “responsible” about running a surplus or “repairing the budget”. This fiscal domination of the economic narrative allowed the Coalition to ignore the hard job of structural reform.

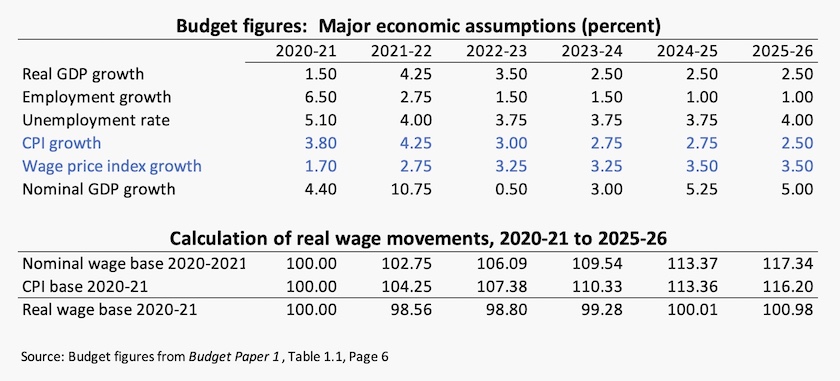

Without productivity growth there cannot be wage growth. That is why the budget shows that over the next four years the government expects there to be no growth in real wages. The government’s expectations are spelled out in the budget’s basic document, Budget Paper No. 1: Budget Strategy and Outlook. The message is simple: real wages are stuck. Or, if one were to read precision in the numbers, there will be a one percent rise in wages but not until 2025-26. The calculation is shown below, using $100 as a base.

It is notable that the government is not even expecting much nominal wage growth for the remainder of this year (only 2.75 percent), even though the labour market is very tight. In times past when Australia had strong trade unions wages would have moved more quickly, but now wage growth is likely to result only from people switching jobs. Economically that’s no bad thing: high labour mobility allows people to move from low-productivity jobs to high-productivity jobs, but it puts most of the cost of adjustment on the shoulders of employees.

Independent economists are generally critical of the budget. Ross Gittins, for example, calls it a sleight of hand– it’s essentially a spend-now-pay-later budget. Peter Martin is one of the few economists to give it a positive rating, but only on its fiscal measures: he does not address questions of economic structure.

1. Assuming the 22.0 cents equates to a 23.4 cent cut once GST is considered, and a fuel efficiency of 10 litres per 100 km. ↩

2. Budget Paper 1, page 345. ↩

Albanese’s reply to the budget

There were no surprises in Albanese’s speech in reply to the Commonwealth budget. Rather than picking apart flaws in Frydenberg’s budget – there are plenty – he presented Labor’s economic agenda.

At the start he made the basic point that the economy is there to serve the people. It shouldn’t be the other way around. That may appear to be a rhetorical filler, but it’s an important point, for in everyday thinking about public policy there is often an assumption, usually implicit, about some trade-off between “society” and “the economy” – an assumption held as much by those on the “left” as by those on the “right”. That’s a distorted understanding of economics: we engage in economic activity – we work and trade – to serve human ends.

He went through Labor’s five economic pillars – powering Australia with renewable energy, reconstructing manufacturing and related industries, investing in infrastructure, investing in skills, and investing in child care. On this last point he stressed the dual function of child care. It’s not just some way to park children while parents go off to work; it’s also an important early step in socialization, acquisition of knowledge and accumulation of skills, which will have personal and society-wide returns over many decades.

And of course he committed Labor to a properly-constituted Commonwealth integrity commission.

The underlying economic theme was about improving productivity, so that our economy can support decent wages, and healthy profits. This is in strong contrast to the Coalition’s approach of seeing low wages as a pre-condition for economic growth – again the notion that “the economy” is some god that has to be appeased by human sacrifice.

His biggest (but predictable) promise was about care for the aged, particularly those in care homes. Had Labor made such a proposal five years ago, before the Commission into Aged Care Quality and Safety was established, and before the faults in aged care were so shockingly displayed during the pandemic, his proposals would have appeared to be radical and extravagant, but they now come across as a common-sense approach to a policy area that has suffered many years of bad policy, neglect, and unjustifiable profits at the expense of the weakest in our community.

One omission from his speech was housing – although Labor has already made some minor promises about subsidies for first-home buyers in non-metropolitan regions (not one of its wisest policies). In view of our ridiculously and dangerously over-valued house prices, it would make sense for a social-democratic party to commit to a large investment in public housing – large enough to make public housing available to those on low incomes, and to make a sufficient contribution to housing supply to reduce house prices generally. His advisers have probably warned him against anything that could connect a Labor government with the inevitable fall in house prices, with its consequent stress on those holding large mortgages. Unless the basic laws of supply and demand have been repealed, that fall and associated distress will almost certainly occur during the term of the next government.

Western Australia’s government celebrates a fiscal rip-off

We are so conditioned by the idea that a fiscal surplus is “good” and that a deficit is “bad” that Western Australian premier Mark McGowan is bragging about a S&P Global Ratings report, glowing in its praise for the state delivering a world-leading fiscal balance during the pandemic – an $11 billion budget surplus.

S&P rightly notes that the McGowan government, in spite of pressure from the Commonwealth and from so-called “business interests”, with its tough policy of local eradication, has handled the pandemic well. This is in contrast to the situation in the eastern states where calculated laxity by the New South Wales government, under pressure from the Commonwealth, has resulted in hundreds of avoidable deaths and widespread economic hardship.

But is a fiscal surplus an unmitigated good? Basically a surplus means that a government has collected more in taxes and fees than it has spent in providing services. In most commercial situations we call that overcharging, or a rip-off. Of course governments have a wider responsibility to the community than most businesses: their responsibility for stabilizing the economy requires them to run fiscal surpluses and deficits in order to even out fluctuations in the business cycle. Perhaps, in Western Australia’s case, because of its dependence on commodity prices, it could be justified in running higher surpluses and deficits than other states.

The McGowan government, however, is unlikely to mention the state’s highly favourable treatment in a deal arranged in 2018 by then-treasurer Scott Morrison, at a time of low iron prices, to ensure that the state would not be disadvantaged by Grants Commission allocations in distributing GST revenue. (See more on Martyn Goddard’s Policy Post.) In 2018 the state had a Liberal government and the Commonwealth was facing an election in the following year in which a number of Perth seats were seen to be at risk. Nor is Morrison likely to mention it, in view of the parlous state of the Liberal Party in Western Australia.

Years of deceitful propaganda by Liberal politicians, echoed by placid and partisan media, have conveyed the impression that all that counts in economic management is the fiscal balance, and the virtue of a surplus. McGowan, and the local branch of the Labor Party, are free-riding on that deceit.

More fundamentally, the way the commodity cycle is bringing different fortunes to different states and regions should prompt a revision of our revenue-sharing arrangements, in line with the settlement at the time of federation. The Rudd government attempted to levy a resource super profit tax, but in the face of a hysterical and deceitful $22 million campaign by mining interests it was watered down, and finally abolished by the Abbott government in 2013.

Wage theft – “systemic, sustained and shameful”

Wage theft – the deliberate underpayment of workers, is costing workers around $5 billion a year. It is rife in labour-intensive industries, in industries employing recent or temporary immigrants, in industries with fragmented value chains (for example, payment through labour-hire firms), and in industries with low union membership. It takes many forms, including outright non-compliance with minimum awards, non-payment of superannuation, sham contracting, and excess deductions of accommodation charges, to name a few.

It is most common in the hospitality, retail, horticulture, cleaning and security industries (the Coalition’s “small business” darlings). It is also common in higher education, a sector that employs many people on casual arrangements. Underpayment of workers has also been found in some large firms, in some not-for-profit organizations, and in some government agencies.

These are the findings of a report Systemic, sustained and shameful: unlawful underpayment of employees' remuneration by the Senate Economics Reference Committee.

It has a comprehensive set of recommendations, mainly concerned with measures to strengthen compliance with existing laws and regulations, and some others that involve making employment regulations more explicit.

Closing the gap

The Productivity Commission has released its latest update of the Closing the Gap dashboard, indicating progress on 17 socioeconomic indicators towards closing the gap between Aboriginal and Torres Straits Islander Australians and other Australians.

On 9 of these indicators there is no new data to report. On the other 8 there is a mixture of positive and negative outcomes. Perhaps the most serious is that suicides among ATSI people is still increasing. On indicators relating to criminal justice the indicators for adults are poor, but for children the same indicators are promising. Children, however, are still over-represented in the child protection system.

The most promising indicator (although it is a hard one to measure) relates to ATSI people maintaining “a distinctive cultural, spiritual, physical and economic relationship with their land and waters”.

One area where the gap has more than closed is in participation in early childhood education. There has been progress among ATSI children, but most of the closure is due to worsening participation among other Australians. Is that the way we should close the gap?

Australia catching up on renewable energy, but still has a long way to go

In 2020 worldwide, electricity generated from wind and solar power drove a record fall in the use of coal to generate electricity, but that was only because the pandemic resulted in a fall in demand.

That’s the main finding of the Global Energy Review, produced by the Ember energy think-tank. It also found that over the ten years to 2020 in most of the G20 countries wind and solar made strong advances, the standout countries being Germany and the UK.

While in most developed countries coal as a source of electricity generation has been falling, it has been rising in Indonesia, Turkey, China, India and Russia. Also, although coal has been losing its share, its place has been taken by gas, particularly in the US. The reduction in coal use is insufficient to avoid a 1.5 degree rise in global temperature.

The review has detailed reports on individual countries. Australia’s entry shows that by world standards we are large electricity users. We have made good progress on taking up wind and solar, but we have a long way to go to catch up with other countries in eliminating coal in our generation mix.

Because it was the only large developed country to see a big increase in coal generation in 2020 it is worth having a look at the China section. It’s adding a heap of solar, wind, other renewable resources and nuclear to its generation mix, but such has been its demand for electricity that coal use is still growing. In the USA, by contrast, while coal use is falling steeply, gas and oil are largely taking its place.

The false equity in cheap public transport

A common urban myth is that investing in public transport and making fares as affordable as possible will be of benefit to the least well-off.

It was probably a valid assumption until 1948 when the Holden FX started rolling off the assembly lines, and perhaps for a few years after that. But no longer is that the case. Public transport in Australian cities is mainly CBD-centred, radiating out to the suburbs, and as it stretches out into the far-flung suburbs where housing starts to be affordable, the public transport networks become very thin. Public transport provides a good service to well-paid CBD workers with regular hours, but not to those who have to make crosstown journeys, who work odd hours on night and weekend shifts – aged-care workers come to mind – and who have to work in multiple locations.

Writing in The Conversation Jago Dodson and Tiebei Li of RMIT University have produced 5 maps that show why free public transport benefits the affluent most, graphically illustrating the above points. Their maps are of Melbourne, but could equally apply to any of Australia’s big “central place” cities. (Only Sydney is slowly breaking into a more dispersed set of centres.)

For example, they show the commuting patterns of retail and hospitality workers whose trips by car are almost entirely crosstown, contrasting them with the patterns of professional, scientific and financial workers, who can use public transport for their CBD commutes.

Does this establish a case for subsidizing gasoline by reducing its excise? Not really: like other economists they see a fairer distribution of income as the best way to overcome these disadvantages and inequities. But their analysis does counter the notion that free or highly-subsidized public transport serves the most disadvantaged. Also, it should give pause for thought to the strident anti-road lobby who try to block every improvement in urban roads.